When your QuickBooks Payroll Update Not Working properly, it can disrupt your entire payroll process and leave employees waiting for their paychecks. This comprehensive guide will walk you through proven solutions to get your payroll updates running smoothly again.

Understanding QuickBooks Payroll Update Errors

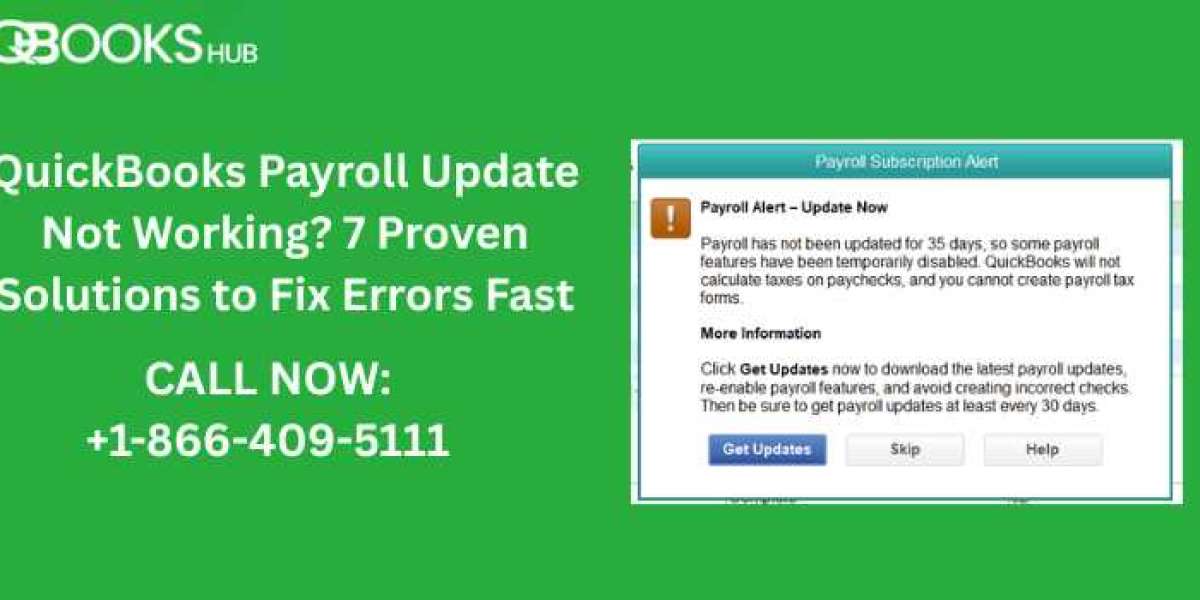

QuickBooks payroll updates are essential for maintaining accurate tax tables, compliance requirements, and employee information. When these updates fail, you might encounter error messages, frozen screens, or incomplete download processes that prevent your payroll from functioning correctly.

Common symptoms of payroll update failures include:

- Error messages during the update process

- Payroll features becoming unavailable

- Incorrect tax calculations

- Missing employee information

- System crashes during payroll processing

Why QuickBooks Payroll Updates Fail

Before diving into solutions, it's crucial to understand what causes these frustrating update errors. Several factors can contribute to QuickBooks Payroll Update Not Working issues:

Internet Connection Problems

A stable internet connection is fundamental for downloading payroll updates. Even brief connectivity issues can interrupt the update process, causing it to fail completely.

Outdated QuickBooks Version

Running an outdated version of QuickBooks can create compatibility issues with newer payroll updates, leading to installation failures and system conflicts.

Firewall and Security Software Interference

Overly aggressive firewall settings or antivirus software can block QuickBooks from accessing the necessary servers, preventing successful payroll updates.

Corrupted System Files

Damaged or corrupted QuickBooks files can interfere with the update process, causing repeated failures and system instability.

Step-by-Step Solutions to Fix Payroll Update Errors

Solution 1: Check Your Internet Connection

Start with the basics by verifying your internet connection stability:

- Test your connection speed using an online speed test tool

- Restart your router and modem to refresh the connection

- Close unnecessary applications that might be consuming bandwidth

- Try updating during off-peak hours when internet traffic is lower

Solution 2: Update QuickBooks to the Latest Version

Keeping QuickBooks current is essential for successful payroll updates:

- Open QuickBooks and navigate to the Help menu

- Select Update QuickBooks Desktop

- Click Update Now and select all available updates

- Restart QuickBooks after the update completes

- Attempt the payroll update again

Solution 3: Configure Firewall and Antivirus Settings

Security software can often interfere with payroll updates:

For Windows Firewall:

- Open Windows Security settings

- Navigate to Firewall Network Protection

- Click Allow an app through firewall

- Add QuickBooks to the exceptions list

For Antivirus Software:

- Access your antivirus control panel

- Add QuickBooks installation folder to exclusions

- Temporarily disable real-time protection during updates

Solution 4: Run QuickBooks as Administrator

Administrative privileges can resolve many update-related issues:

- Right-click on the QuickBooks desktop icon

- Select Run as administrator

- Confirm the action when prompted

- Attempt the payroll update with elevated privileges

Solution 5: Clear QuickBooks Cache and Temporary Files

Corrupted cache files can prevent successful updates:

- Close QuickBooks completely

- Press Windows + R to open Run dialog

- Type

%temp%and press Enter - Delete all temporary files related to QuickBooks

- Restart QuickBooks and try updating again

Solution 6: Use QuickBooks Tool Hub

The QuickBooks Tool Hub provides specialized diagnostic tools:

- Download the latest QuickBooks Tool Hub from Intuit

- Install and run the Tool Hub

- Select Installation Issues tab

- Run QuickBooks Install Diagnostic Tool

- Restart your computer after the process completes

Solution 7: Manual Payroll Update Download

If automatic updates continue failing, try manual downloading:

- Visit the Intuit website and navigate to payroll updates

- Download the latest payroll update for your QuickBooks version

- Save the file to a known location on your computer

- Run the downloaded file as administrator

- Follow the installation prompts carefully

Read This Blog: QuickBooks Payroll Direct Deposit

Advanced Troubleshooting Techniques

Registry Repair for Persistent Issues

Sometimes registry errors can cause ongoing payroll update problems:

- Create a system restore point before making changes

- Use Windows Registry Editor (regedit) carefully

- Navigate to QuickBooks registry entries

- Look for corrupted or missing entries

- Restore or repair damaged registry values

Reinstalling QuickBooks Payroll Service

For severe cases, reinstalling the payroll service might be necessary:

- Uninstall QuickBooks through Control Panel

- Remove all remaining files and folders

- Download fresh installation files from Intuit

- Reinstall QuickBooks with administrator rights

- Restore your company file and reconfigure payroll settings

Prevention Tips for Future Updates

Regular maintenance practices:

- Schedule automatic updates during low-activity periods

- Maintain stable internet connectivity

- Keep system software updated

- Regular system backups before major updates

- Monitor system resources during update processes

Best practices for smooth operations:

- Close unnecessary programs before updating

- Ensure adequate disk space availability

- Regular system cleaning and optimization

- Professional maintenance for complex systems

When to Seek Professional Help

While many payroll update issues can be resolved using these solutions, some situations require expert assistance. Consider professional help when:

- Multiple solutions have failed to resolve the issue

- Your payroll data appears corrupted or missing

- System crashes occur repeatedly during updates

- You're uncomfortable performing advanced troubleshooting

- Time constraints require immediate resolution

For immediate expert assistance with your QuickBooks Payroll Update Not Working issues, contact professional support at +1-866-409-5111. Certified technicians can provide personalized solutions and ensure your payroll system operates smoothly.

Frequently Asked Questions

Q1: How often should I update QuickBooks payroll?

A: QuickBooks payroll should be updated regularly, typically monthly or whenever Intuit releases new tax table updates. Enable automatic updates to ensure you're always current with the latest compliance requirements.

Q2: What should I do if payroll update errors persist after trying all solutions?

A: If standard troubleshooting doesn't resolve the issue, contact professional support at +1-866-409-5111 for specialized assistance. Persistent errors may indicate deeper system issues requiring expert intervention.

Q3: Can I run payroll without the latest updates?

A: While technically possible, running payroll without current updates can result in incorrect tax calculations and compliance issues. Always ensure you have the latest payroll updates before processing employee payments.

Q4: Will updating QuickBooks affect my existing payroll data?

A: Properly executed updates should not affect your existing payroll data. However, it's recommended to create a backup of your company file before performing any major updates as a precautionary measure.

Q5: How can I prevent future payroll update errors?

A: Maintain a stable internet connection, keep QuickBooks updated, configure firewall settings appropriately, and perform regular system maintenance. Schedule updates during periods of low system activity for best results.