Investing in gold bars has long been a favored strategy for preserving wealth and diversifying investment portfolios. As one of the oldest and most reliable forms of currency, gold continues to hold its value even in the face of economic uncertainty. In this comprehensive guide, we explore the intricacies of buying gold bars, providing insights, tips, and considerations to help you navigate this esteemed market with confidence.

Why Buy Gold Bars?

Gold bars offer investors several compelling advantages:

Tangible Asset: Unlike stocks, bonds, or other financial instruments, gold bars are physical assets that you can hold in your hand. This tangibility provides a sense of security and permanence, making gold bars an attractive option for those seeking to diversify their investment holdings.

Store of Value: Gold has a long history of retaining its value over time. As a finite buy gold bars and universally recognized asset, gold serves as a hedge against inflation, currency devaluation, and economic instability, preserving wealth for future generations.

Portfolio Diversification: Including gold bars in your investment portfolio can help spread risk and reduce volatility. Gold has historically exhibited low correlation with other asset classes, such as stocks and bonds, making it an effective diversification tool.

Steps to Buying Gold Bars

Research: Before making any purchase, take the time to research the gold market, familiarize yourself with different types of gold bars, and understand factors that influence gold prices.

Set a Budget: Determine how much you are willing to invest in gold bars. Consider your financial goals, risk tolerance, and investment timeframe when setting your budget.

Choose a Reputable Dealer: Look for reputable dealers or authorized distributors who offer genuine, high-quality gold bars. Check customer reviews, certifications, and accreditations to ensure legitimacy.

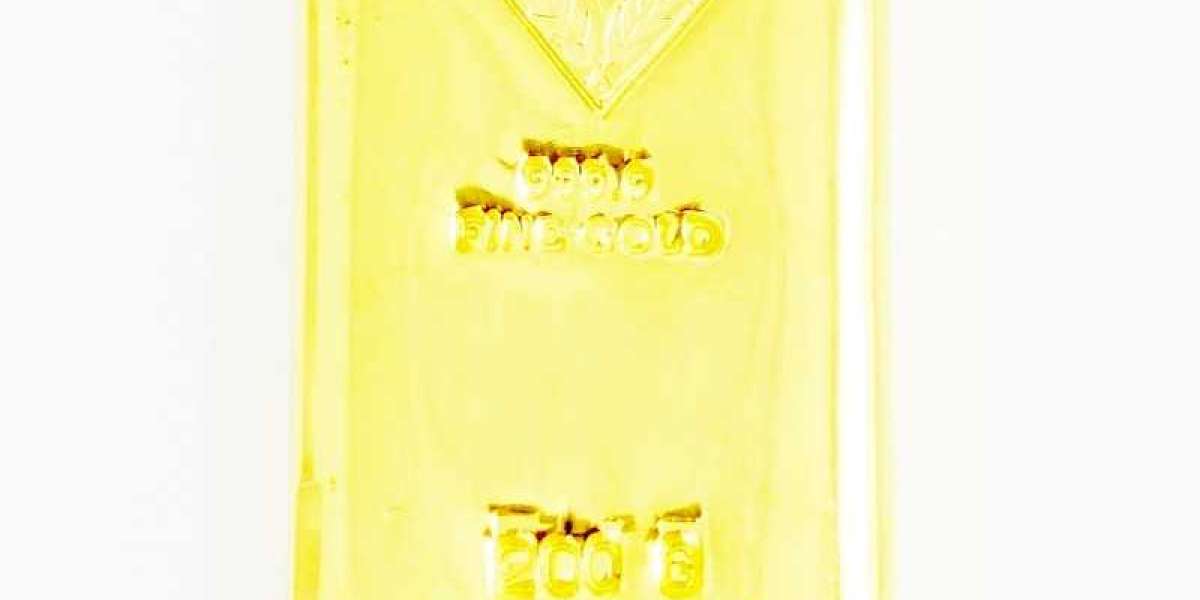

Select the Right Gold Bar: Consider factors such as weight, purity, and premium when choosing a gold bar. Common sizes include 1g, 5g, 10g, 1oz, and larger denominations such as 100g or 1kg.

Verify Authenticity: Before completing the purchase, verify the authenticity of the gold bars. Look for official hallmarks, serial numbers, and certificates of authenticity provided by reputable mints or refineries.

Arrange Secure Storage: Plan for secure storage options for your buy gold bars, such as safe deposit boxes, home safes, or secure vault facilities, to protect your investment from theft or damage.

Monitor Market Trends: Stay informed about market trends, gold prices, and economic developments that could impact the value of your gold bars over time.

Conclusion

In conclusion, buying gold bars can be a rewarding investment strategy for those seeking to protect and grow their wealth. By understanding the advantages of gold as an investment asset, following a systematic approach to purchasing gold bars, and exercising diligence in selecting reputable dealers and authentic products, investors can navigate the gold market with confidence and sophistication. Whether as a hedge against economic uncertainty, a store of value for future generations, or a portfolio diversification tool, gold bars offer a tangible pathway to financial security and prosperity.