SR22 insurance is required after certain driving offenses.

Tennessee DMV requires submitted SR22 forms.

Comparing quotes saves time and money.

Higher deductibles lower SR22 premiums.

Bundling policies reduces overall cost

You can obtain SR22 as a non-owner, but you're checking policy limitations, and non-owner coverage typically doesn't cover vehicles you own, which affects your overall insurance needs and costs considerabl

You can also investigate options like increasing your deductible or dropping unnecessary coverage to reduce your premiums. Additionally, some insurance providers offer discounts for certain driver profiles or vehicle safety features. When evaluating low-cost options, make sure you're not compromising on vital coverage. You should prioritize your safety and financial security by selecting a policy that balances affordability with adequate protection. By carefully comparing rates and reviewing your budget, you can find affordable SR22 insurance in Tennessee that meets your needs. This enables you to make informed decisions about your insurance coverag

You're determining SR22 insurance TN duration, it varies, typically you're required to carry SR22 insurance for 3 years, fulfilling SR22 requirements to reinstate your license after suspension. (personal automobile liability insurance polic

Generally, when shopping for SR22 insurance in Tennessee, you'll want to compare rates frequently to save money - How to get SR22 insurance TN insurance in TN. You're likely looking for cost effective strategies to reduce your insurance expenses. By comparing rates from multiple providers, you can identify budget friendly choices that meet your needs. It's important to evaluate the coverage options (SR22 insurance help In TN) and discounts offered by each insurer to make an informed decisi

You can also engage in comparison shopping to find the best rates. This involves researching and comparing quotes from multiple insurance providers to identify the most competitive prices. By doing so, you can potentially save hundreds of dollars on your SR22 insurance premiums (personal automobile liability insurance policy). Additionally, consider bundling your policies or increasing your deductible to lower your costs. It's crucial to weigh the pros and cons of each strategy to guarantee you're getting the best value for your money while maintaining adequate coverage. By being proactive, you can secure affordable SR22 insurance in Tenness

Choosing the right insurance company is essential when you're shopping for cheap SR22 insurance in Tennessee, and you'll likely research different providers frequently to find the best fit. You'll want to evaluate insurance ratings, which indicate a company's financial stability and ability to pay claims. Look for companies with high ratings from reputable agencies, such as A.M. Best or Moody's. Additionally, consider the customer service offered by each provider, as you'll want to guarantee you can easily get help when you need it. You can assess customer service by reading reviews, checking the company's website, and contacting their support team directly. By researching insurance ratings and customer service, you can narrow down your options and find a reliable company that meets your needs. This will help you make an informed decision and guarantee you're protected on the road. Your safety is a top priority, and the right insurance company can provide you with peace of min

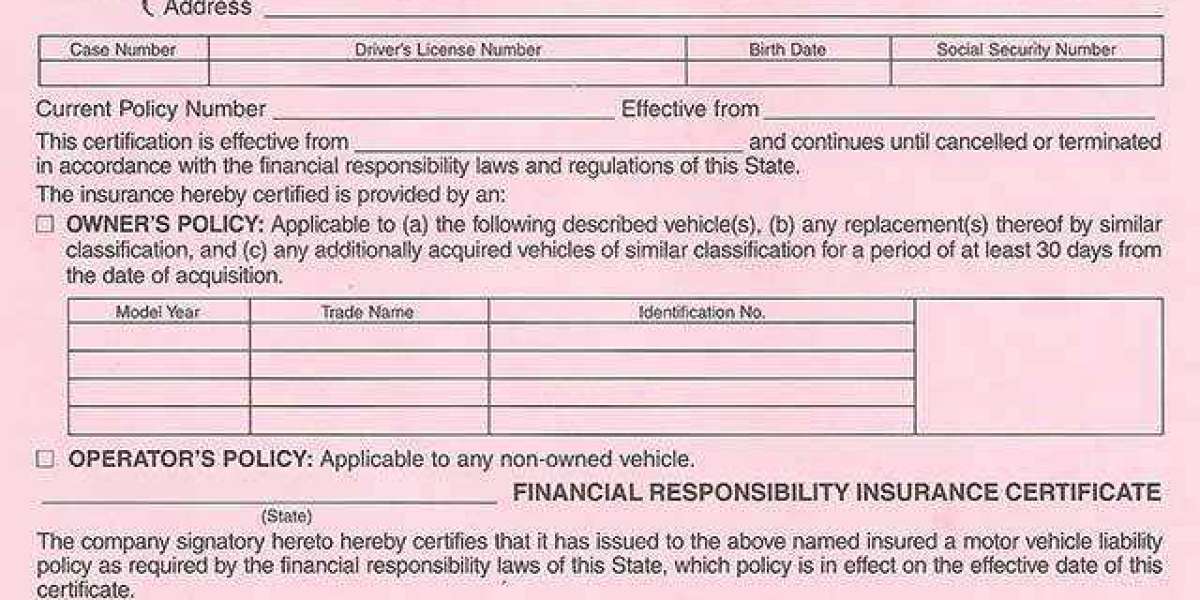

You'll need to make certain you have all the necessary documents before starting the sr22 filing process. This includes your insurance policy information and driver's license details. SR22 insurance help In TN. By following the sr22 eligibility criteria and filing process, you can guarantee compliance with Tennessee's regulations and maintain your driving privileges. It's crucial to carefully review the requirements to avoid any delays or issues with your SR22 fili

You must have bodily injury liability coverage of at least $25,000 per person and $50,000 per accident

You must have property damage liability coverage of at least $15,000

You may need to file an SR22 form with the state if you've had a lapse in coverage or been convicted of certain offenses

You can face penalties, including fines and license suspension, if you don't meet the Tennessee requirements. You should review your policy to ascertain it meets the state's requirements, and consider consulting with an insurance professional if you're unsure. This will help you avoid any legal implications and ascertain you're in compliance with Tennessee's insurance law

When evaluating insurance options, you should prioritize affordable premiums without sacrificing essential coverage. Low-cost SR22 policies Tennessee. By doing so, you can obtain budget friendly coverage that allows you to drive legally and safely in Tenness

You'll need to provide proof of insurance to the state, which is where the SR22 form comes in. This form certifies that you have the required insurance coverage. By choosing a cheap SR22 option, you can get back on the road quickly and easily. You'll be able to find affordable rates that fit your budget, and you won't have to break the bank to get the coverage you need (Low-cost SR22 policies Tennessee). With cheap premiums and budget-friendly options, you can get the insurance you need to drive safely and legally in Tenness

elanablankinsh

1 Blog posts