You've completed the SR22 filing process, and now it's time to contemplate the financial implications of SR22 insurance. SR22 insurance cost in TN in Tennessee. You'll need to evaluate the costs associated with SR22 insurance quotes and the various sr22 policy types availab

Accidents or collisions you've been involved in

Traffic citations or tickets you've received

Any suspensions or revocations of your driver's license

(personal automobile liability insurance policy)

You should be aware that these factors can affect your insurance premiums, making them higher than they would be for a driver with a cleaner record. By understanding how your driver history impacts your SR22 insurance rates, you can take steps to minimize the costs and stay safe on the road. This knowledge will help you make informed decisions about your insurance coverag

When evaluating insurance companies, you'll find that some offer more extensive coverage options. SR22 auto insurance in TN than others. You'll also notice variations in customer service, with some companies providing 24/7 support and others having limited hours of operation. tennessee Sr22 coverage. Policy discounts can also vary greatly between companies, so it's important to ask about available discounts, such as bundling or good driver discounts. By carefully comparing insurance companies, you can make an informed decision and choose a provider that meets your needs and budget, ensuring you have the safety and protection you desire on the ro

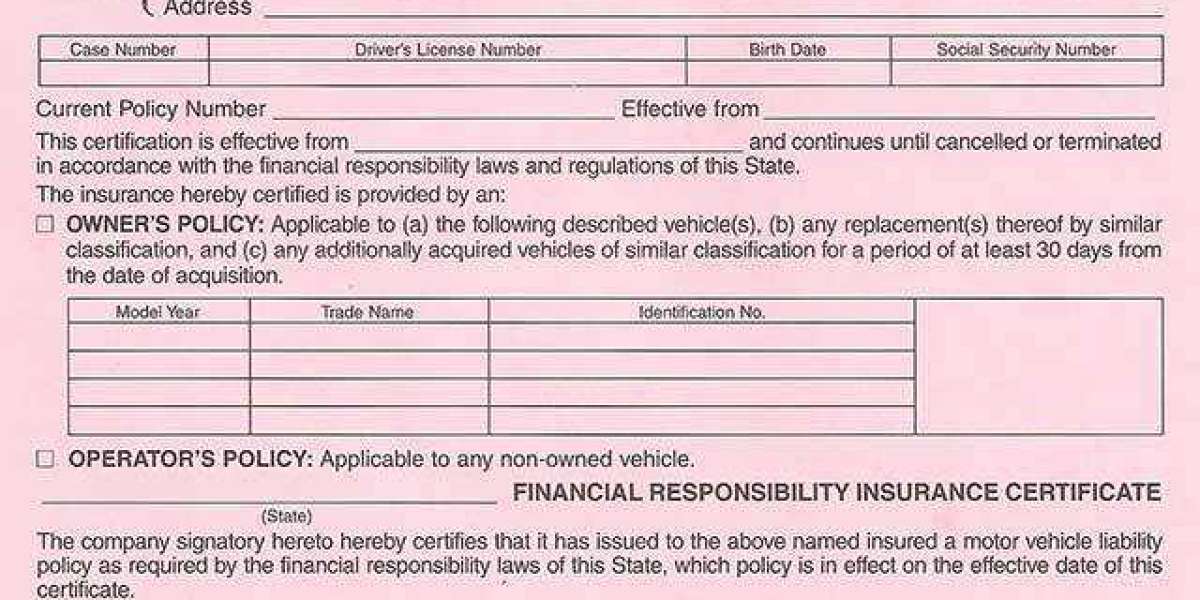

You'll find that your driver history, including any accidents or tickets, greatly impacts your SR22 insurance rates in Tennessee. The type of vehicle you own and the coverage limits you choose also play an essential role in determining how much you'll pay for SR22 insurance TN insurance. When you're shopping for cheap SR22 insurance (personal automobile liability insurance policy) in TN, you should consider these factors, as they can increase or decrease your rates, depending on your specific situati

You're finally finding fairly priced SR22 insurance in Tennessee. personal automobile liability insurance policy. Fearless financial forecasts facilitate fervent frustration fixes, freeing fretful fund management. Carefully crafted coverage configs can cleverly cut costly company claims, cushioning crafty consumers' cash crunches. Strategic savings skills shore up sound spending systems, soothing sensitive sentiments surrounding stern state standar

Several local agents in Tennessee can help you obtain SR22 insurance from authorized carriers - SR22 insurance cost in TN. You'll benefit from working with local agents, as they're familiar with state regulations and insurance requirements. Their roles include guiding you through the application process, helping you understand policy terms, and ensuring you comply with Tennessee's SR22 la

You're maneuvering Tennessee's SR22 insurance process after a driving offense, so you'll need to understand the state's requirements. You must maintain coverage for at least three years and face penalties for non-compliance - SR22 insurance cost in TN. You'll research authorized insurers, evaluate costs, and file the SR22 form with the state. Your next steps will involve managing financial obligations and completing the reinstatement process. As you move forward, you'll encounter specific guidelines and deadlines that you'll need to follow to get back on the road, and understanding these details is essential to successfully completing the proce

Several insurance companies in Tennessee offer SR22 insurance, and it's your job to research and evaluate - personal automobile liability insurance policy them. You need to compare coverage options and make informed decisions to guarantee you're getting the best policy for your needs. When evaluating insurance companies, consider the following factor

You're considering cancelling policies, but early termination of SR22 insurance may have implications, so you're evaluating options carefully before making a decision, ensuring you're not compromising your safety coverage. (personal automobile liability insurance polic

You'll initiate the SR22 cancellation process, understanding SR22 policy implications, and you're canceling it, you'll notify your insurer, who'll notify the state, but you're still responsible for maintaining coverage. (personal automobile liability insurance polic

You're checking SR22 requirements, driving restrictions apply, you can't drive another car without notifying your insurer, they'll outline specific SR22 rules, ensuring you don't violate terms, you must comply. SR22 auto insurance in T

Your insurance provider must offer a policy that meets Tennessee's SR22 requirements, which typically include liability coverage. SR22 auto insurance in TN of at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage. You'll need to review the coverage types and policy limits to guarantee you're adequately protect

liamnaranjo618

1 Blog Mensajes