Running a business in Wisconsin means dealing with different kinds of taxes, and one of the most important is sales tax. Whether you're selling goods in a physical store, online, or through both, knowing the right sales tax is crucial. The Wisconsin Sales Tax Calculator helps ensure you are charging your customers correctly and staying within legal guidelines. When used properly, it can save time, prevent errors, and make your financial planning more accurate.

Wisconsin has a state sales tax rate of 5%, but this isn't the whole picture. Many counties and cities in Wisconsin also add their own local tax rates. That means depending on where your customer is located, the final sales tax might be higher than the state’s base rate. For business owners, keeping track of these changes manually can be frustrating and confusing. This is where tools like the Wisconsin sales tax calculator come in handy.

Let’s say you’re a clothing boutique in Milwaukee or a handmade soap seller shipping items to different Wisconsin cities. The prices you show or charge must include the correct sales tax based on the customer’s delivery or purchase location. The sales tax calculator Wisconsin tools are designed to handle this level of detail without requiring you to remember every local tax rule.

Using a dedicated sales tax in Wisconsin calculator means fewer mistakes in your invoices. It can also help you avoid penalties during tax season. Many small business owners often find themselves correcting mischarges or even overpaying to the government because of miscalculations. A proper calculator can make sure you’re charging the right amount from the start.

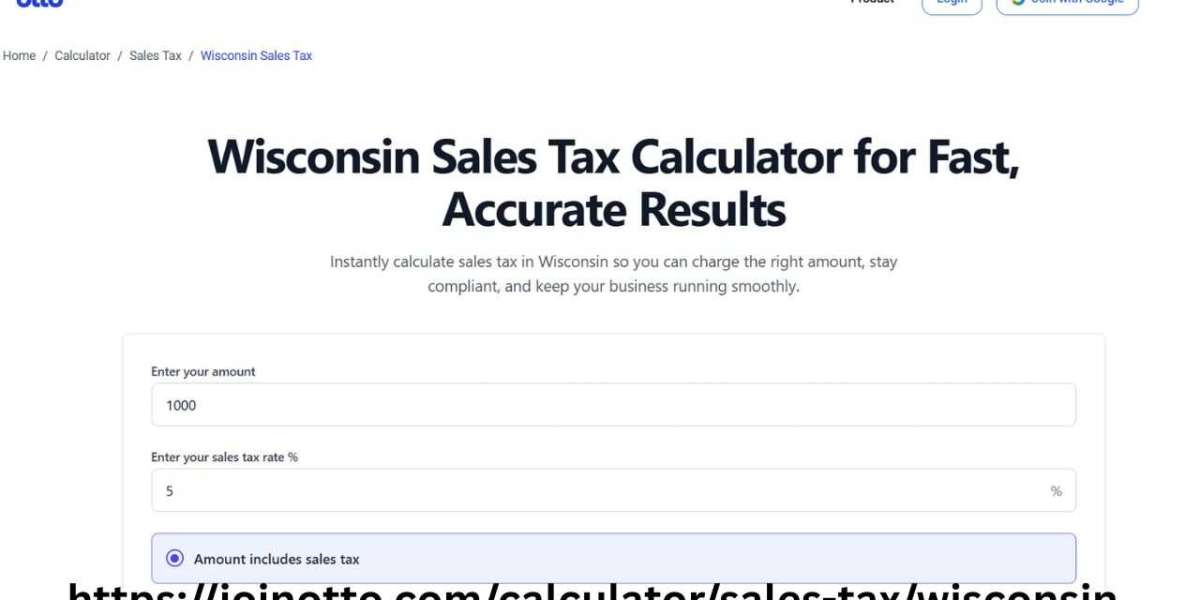

Otto AI offers a Wisconsin sales tax calculator that is fast, simple, and fits right into your everyday business tools. Whether you're using a POS system in-store or sending invoices online, this tool can help you plug in your product price and instantly see how much tax should be applied. It’s designed to work for entrepreneurs, freelancers, and online sellers who want clarity and accuracy without going deep into tax codes.

Sales tax calculator Wisconsin tools are also useful during sales planning. For example, if you're preparing a seasonal promotion and want to keep prices attractive while still covering taxes, you can calculate the total cost beforehand. This gives you full control over your margins and prevents surprises after a sale is completed. Transparency also builds trust with customers when they see exactly what they’re paying for, including taxes.

Sometimes sellers forget that digital products, event tickets, and even repair services might be taxable in Wisconsin depending on the rules. It’s not always just about physical goods. That’s why relying on a sales tax Wisconsin calculator is safer than trying to guess or look up the rules every time. It saves time, reduces risk, and keeps your records clean.

Let’s look at another scenario. Suppose you’re self-employed and travel to multiple cities in Wisconsin offering your services. Charging the right sales tax based on location can be tricky without the right support. With a sales tax in Wisconsin calculator, you can enter the city or county name and immediately get the correct tax rate to apply on your invoice or receipt. This can make a big difference if you serve many clients and don’t want to spend hours tracking tax rates.

Also, the Wisconsin sales tax calculator can be a great learning tool if you’re new to business. You’ll slowly start to recognize patterns in tax rates across different areas, helping you price your products or services better over time. You’ll also find it easier to respond when customers ask why they’re being charged a specific amount for tax. Knowledge like this improves your professional image.

Using a calculator also helps during tax filing. When all your receipts are correct and consistent, it's easier to file your sales tax returns. You won’t be digging through emails or spreadsheets trying to find where a tax error happened. It also means fewer adjustments or audits from the Wisconsin Department of Revenue.

Otto AI’s Wisconsin sales tax calculator is designed with business owners in mind. You don’t need to be an accountant to use it. There are no complicated settings, and you don’t have to download anything. Just enter your location, price, and let the tool do the rest. It’s reliable, accurate, and can grow with your business.

Another benefit of using a sales tax calculator Wisconsin tool is that it creates confidence in your pricing strategy. Whether you’re quoting clients, setting up online store pricing, or printing price tags, you can be sure the tax is already figured in. This reduces customer complaints, returns, or misunderstandings about final costs.

In Wisconsin, sales tax rules may change due to government updates, and that can be stressful to track. The right calculator tool stays current with the latest changes so that you don’t have to. You get peace of mind knowing the rates are accurate and your business is following the law.

Even if you’re selling at a weekend market, offering a one-time workshop, or launching a new product, a Wisconsin sales tax calculator gives you a consistent and legal way to handle sales tax. No matter the size of your business, this tool can bring structure to your pricing.

To sum it up, the Wisconsin Sales Tax Calculator is an important resource for anyone running a business in the state. From planning prices to issuing receipts and filing taxes, it keeps your process smooth and error-free. By including this tool in your daily business routine, you are reducing guesswork, protecting your business, and improving customer satisfaction. Whether you are just starting out or growing fast, using the Wisconsin sales tax calculator from Otto AI can make your financial life easier and more reliable.