Paying taxes is a regular part of doing business in Massachusetts, and for entrepreneurs, freelancers, and small business owners, understanding how to handle sales tax is essential. Whether you’re selling handmade crafts, consulting services, or running an online store, knowing how much sales tax to charge and pay can impact your profits and compliance. This is where the Massachusetts Sales Tax Calculator comes into play. With Otto AI, managing your sales tax becomes less of a headache and more of a routine step in your daily business operations.

Massachusetts has a statewide sales tax rate that applies to most retail sales of tangible personal property and certain services. If you operate within the state, it’s important to know which of your products or services are taxable, and how to calculate that tax correctly. Mistakes in tax calculation can lead to underpayment, overcharging customers, or facing penalties from the Department of Revenue. The good news is that tools like a sales tax calculator Massachusetts can take the guesswork out of it.

Let’s say you own a boutique in Boston or you’re a self-employed designer in Worcester. You make a sale worth $100. With a sales tax rate of 6.25%, the amount you collect in tax is $6.25. Simple, right? But what happens when the purchase involves multiple items, or you have to consider tax exemptions? Manually figuring all this out for each transaction can be time-consuming. That’s where Otto AI steps in with its Massachusetts sales tax calculator designed for ease and speed.

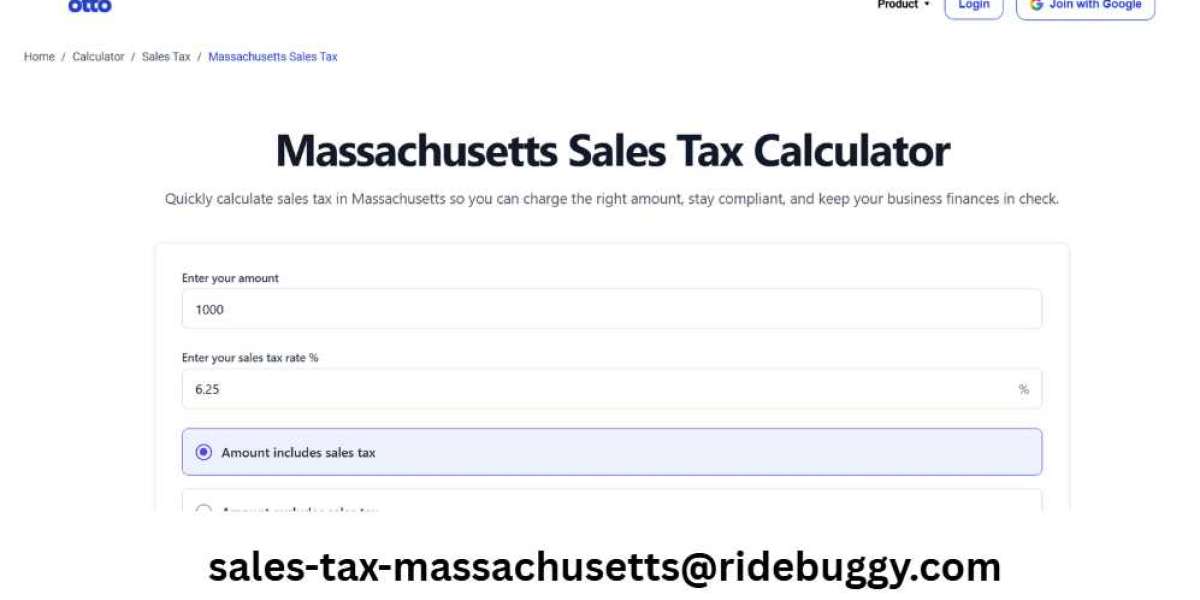

Otto AI’s tax calculator can instantly compute the right tax amount based on your sale value. You input the amount of your sale, and it gives you the correct tax total, factoring in Massachusetts rules. No manual math, no confusion. This is especially helpful during busy business periods like holiday seasons or end-of-quarter sales when you’re dealing with dozens or even hundreds of transactions.

What makes this tool ideal for self-employed professionals and small business owners is its simplicity. It doesn’t require any accounting background or complex setup. You don’t need to scroll through state tax documents or navigate complicated spreadsheets. You just enter the numbers, and the calculator does the rest. This reduces the risk of human error, especially when your mind is on other parts of running your business.

Some might wonder, why not just calculate taxes manually or use a regular calculator? The answer lies in accuracy and peace of mind. Massachusetts tax laws can change, and certain items may be taxed differently based on the context of the sale. Otto AI keeps its sales tax massachusetts calculator updated with the latest tax rules, so you never fall behind. That way, you’re not just saving time—you’re also ensuring compliance with current regulations.

Another major benefit is how helpful it is for recordkeeping. If you’re preparing monthly reports or getting ready for tax filing, having an accurate trail of the tax collected per transaction is invaluable. Otto AI can help generate summaries based on your use of the calculator, making tax season less stressful. That’s something every entrepreneur can appreciate.

Let’s not forget the customer experience. No one likes seeing surprise charges at checkout, especially when they don’t understand where they came from. A clear and accurate tax total calculated with Otto AI’s tool helps maintain trust with your customers. It shows professionalism, and that you take your pricing seriously.

For online sellers, this is especially important. With customers coming from different parts of the state—or even different states—you need to make sure you’re charging the correct rate depending on the shipping location. Otto AI’s sales tax calculator Massachusetts tool helps handle these variables efficiently, so you’re always charging the right amount without guesswork.

Massachusetts has some specific rules, too. For example, certain clothing items under $175 may be exempt from sales tax, while anything over that amount could be taxable. There are also tax holidays and seasonal rules. These finer details can be hard to keep up with manually, but tools like Otto AI are built to include such nuances automatically. That means you can focus on your work, not on memorizing tax codes.

For self-employed individuals who invoice clients directly, having a tool like this is even more useful. You can confidently add the correct sales tax to your invoices without needing to double-check the percentage every time. This not only saves time but also builds trust with clients who expect clarity and transparency.

Otto AI also makes it easier to educate your team, if you have one. Instead of training employees on manual calculations or letting them rely on estimates, you can guide them to use the calculator for every sale. This ensures consistency across your business, whether it’s you ringing up a sale or a part-time team member.

Overall, using a Massachusetts sales tax calculator isn’t just about doing math. It’s about keeping your business smooth, professional, and compliant. Otto AI offers a reliable tool that aligns with the needs of today’s entrepreneurs, helping you stay focused on growth instead of paperwork. With such tools, you don’t need to be a tax expert—you just need to be smart about using the right resources.

To sum it up, handling sales tax in Massachusetts doesn’t have to be a difficult task. With Otto AI’s Massachusetts sales tax calculator, you get a simple, quick, and accurate way to stay on top of your tax responsibilities. It’s a time-saving solution for busy professionals who want to focus on their business, not their calculators. Let Otto AI handle the numbers while you concentrate on building your success.