Managing taxes can feel overwhelming, especially when you are running a business. For business owners and self-employed individuals in Maryland, knowing how much sales tax to collect and pay is a crucial part of staying compliant. This is where a Maryland sales tax calculator becomes a practical tool to help you stay on track with your finances. Whether you are selling products in-store, online, or providing taxable services, having an accurate method to calculate sales tax ensures that you avoid costly mistakes.

Sales tax in Maryland is generally straightforward, but it does come with a few important details that every business owner should understand. The state imposes a 6% sales tax rate on most goods and some services. Unlike other states that have a combination of state, county, and city taxes, Maryland applies a flat rate, which simplifies the process for sellers. However, certain goods such as alcohol and tobacco may be subject to different tax rules.

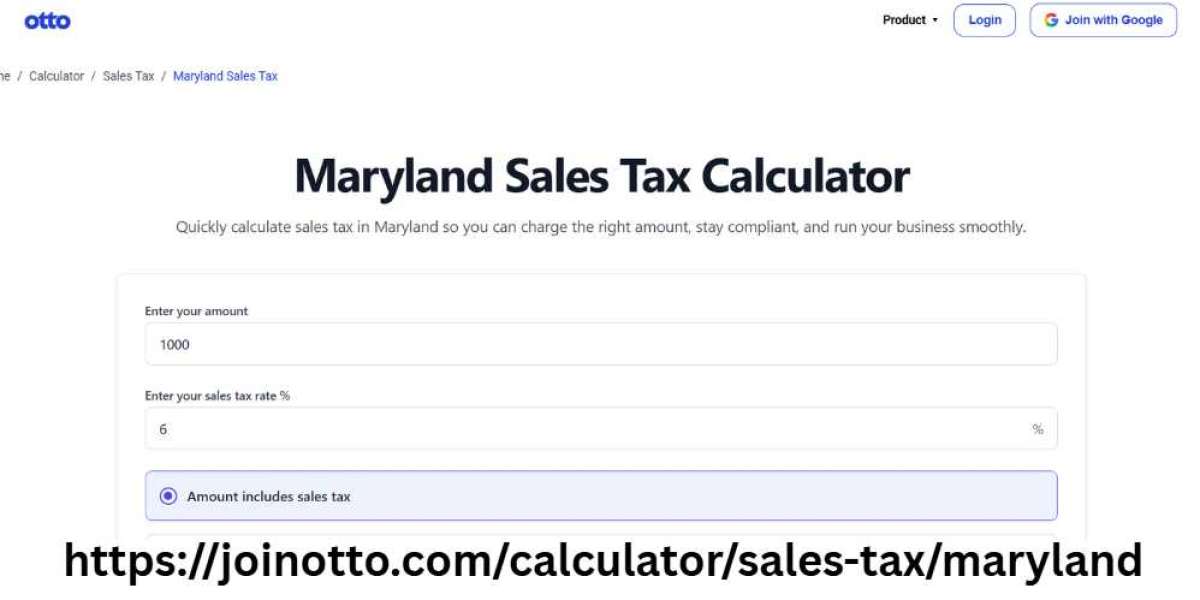

For a business, especially a small or self-employed entrepreneur, manually figuring out taxes on every transaction can consume valuable time. This is where the need for an efficient sales tax calculator Maryland becomes apparent. Tools like the Otto AI Maryland Sales Tax Calculator automate the process by accurately calculating the exact tax amount based on the price of the item. You simply enter the product price, and it instantly provides the tax amount and the total price including tax.

Using a sales tax Maryland calculator removes the guesswork from your daily operations. It ensures that you charge the correct amount to customers, which is essential not just for compliance, but also for maintaining customer trust. Overcharging can lead to unhappy customers, while undercharging might result in penalties from tax authorities.

In Maryland, certain sales may be exempt from tax depending on the nature of the goods and the buyer’s status. For instance, non-profit organizations or government agencies making purchases for official use may qualify for exemption. If you are a business dealing with both taxable and non-taxable sales, a sales tax in Maryland calculator that allows for quick inclusion or exclusion of tax on specific items is very beneficial.

One of the biggest advantages of using a sales tax calculator for Maryland is that it helps maintain accuracy in your bookkeeping. As a business, you are required to report and remit sales tax collected from customers to the Maryland Comptroller's Office. Any discrepancies can lead to audits and potential fines. Automated calculators like Otto AI’s solution ensure that every cent is accounted for, reducing the risk of human error.

Online retailers operating within Maryland or shipping goods to Maryland addresses also need to charge sales tax. This includes self-employed entrepreneurs running e-commerce businesses. A reliable sales tax calculator Maryland ensures that you collect the right amount for every online sale, regardless of the platform you use. Otto AI provides a digital tool that fits seamlessly into your daily operations, giving you clarity on every transaction.

For brick-and-mortar stores, a point-of-sale system integrated with a sales tax Maryland calculator saves time during checkout. It prevents delays and ensures smooth customer interactions. The process is simple: input the product’s price, and the calculator instantly displays the tax and total price, allowing for quicker billing and transparent communication with the customer.

Service-based businesses that fall under taxable services also benefit from using a sales tax in Maryland calculator. For example, if you provide cleaning services or repair services that are taxable, you can use the calculator to determine the correct tax amount before invoicing your client. This promotes professionalism and accuracy, two key elements that build long-term business relationships.

Moreover, using a dedicated sales tax calculator for Maryland simplifies monthly and quarterly tax filings. At the end of the reporting period, you can generate a summary of the total sales and tax collected, making the filing process much less stressful. Otto AI’s calculator is designed to keep track of your tax amounts, so you don’t have to go through spreadsheets or manual records when filing returns.

Incorporating a Maryland sales tax calculator into your business processes also has long-term financial benefits. By ensuring accurate tax collection, you avoid the risk of back-payments, interest, and penalties. Additionally, it gives you a clearer picture of your revenue and expenses, which is essential for budgeting and financial planning.

For self-employed individuals, freelancers, and small business owners, the ability to handle tax calculations efficiently means you can focus more on growing your business rather than getting stuck in paperwork. Otto AI understands the importance of time and accuracy in running a business, and its Maryland Sales Tax Calculator is designed with these needs in mind.

The tool is accessible online, requires no complex software installations, and can be used on various devices including smartphones, tablets, and desktops. This flexibility means you can calculate taxes whether you’re in your office, store, or even on the go. It adapts to your workflow, ensuring you always have accurate numbers at your fingertips.

One of the lesser-discussed yet important aspects is how using a sales tax calculator Maryland helps in audit preparedness. Keeping clean and accurate records of how tax amounts were calculated provides an added layer of security in case of audits. Digital tools like Otto AI’s calculator not only automate the calculations but also maintain a digital trail that can be referenced when needed.

Additionally, educating your staff on using the sales tax Maryland calculator ensures that everyone in the team is aligned. Whether it’s your sales team, cashier, or accounting staff, having a standardized tool minimizes the risk of errors across different departments. This promotes consistency and enhances overall business efficiency.

To sum it up, a Maryland sales tax calculator is more than just a tool—it’s a necessity for any business looking to maintain accuracy, save time, and ensure compliance. It helps self-employed professionals and entrepreneurs handle tax calculations effortlessly, ensuring that they stay on top of their tax obligations without stress. Otto AI’s Maryland Sales Tax Calculator is a reliable solution designed to meet these needs, offering a seamless experience for everyday business operations.

By integrating such tools into your workflow, you’re not only safeguarding your business from errors and penalties but also creating a smoother experience for your customers. Embracing digital solutions like Otto AI's Maryland Sales Tax Calculator prepares your business for efficient growth while keeping you in control of your finances.