When running a business in Nevada, keeping track of sales tax is a task that demands accuracy and attention. Whether you are a local shop owner, freelancer, or an entrepreneur managing an online store, knowing the correct sales tax is essential to stay compliant and avoid penalties. The Nevada Sales Tax Calculator is a useful tool that makes this process much easier by providing quick and accurate tax calculations on every transaction. Otto AI offers an easy-to-use solution that can help businesses handle these calculations without stress.

Nevada has a base state sales tax rate, but depending on where the sale happens, additional county or city taxes may apply. This can make calculating sales tax a little confusing, especially when you are managing multiple sales in different areas. A Nevada sales tax calculator takes out the guesswork and gives you the exact tax amount you need to collect or pay. This is where Otto AI becomes a valuable assistant, offering a tool that is designed for business owners who need accurate numbers at their fingertips.

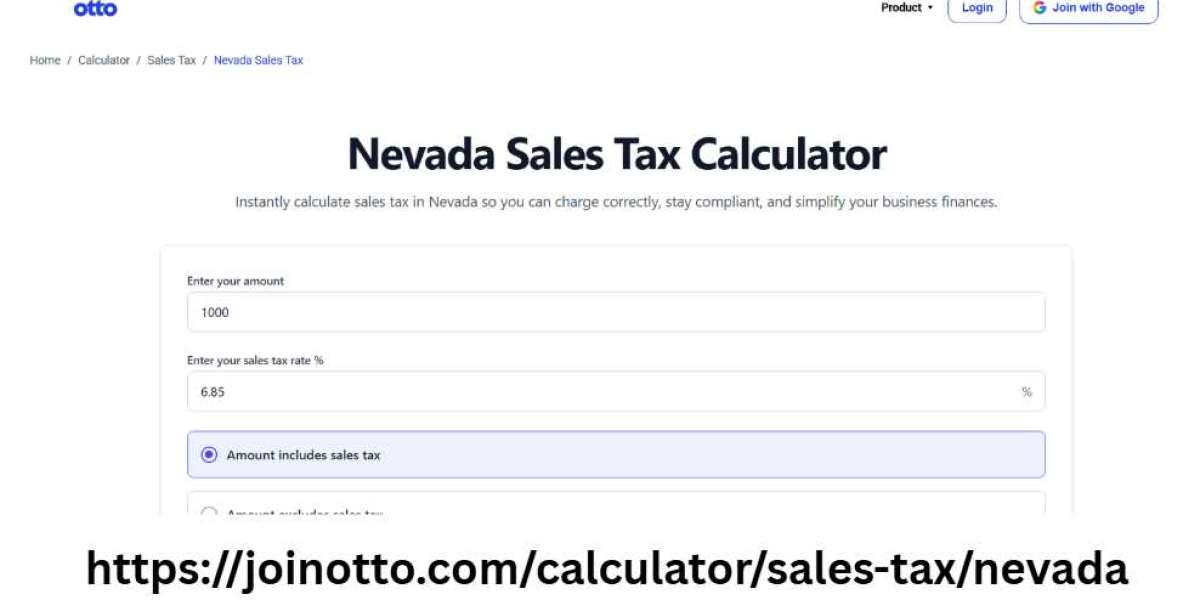

One of the common challenges businesses face is dealing with varying tax rates in Nevada. For example, the state rate might be 6.85%, but local jurisdictions can add extra percentages. Keeping track of these changing rates manually can lead to errors. A sales tax calculator Nevada businesses can rely on helps to eliminate such mistakes. Otto AI’s Nevada sales tax calculator ensures that every sale is calculated using the correct rate, giving you peace of mind during audits and daily transactions.

Using a digital tool like a sales tax Nevada calculator not only saves time but also improves the accuracy of your accounting records. Manually calculating tax for each sale is time-consuming and increases the chances of human error. Otto AI understands this problem and provides a Nevada state sales tax calculator that instantly delivers results, helping you focus more on your business and less on complicated tax math.

Entrepreneurs and small business owners need to ensure their invoices are accurate, especially when dealing with clients from different cities within Nevada. The Nevada sales tax calculator helps you apply the correct rate based on the transaction location. Otto AI has designed its platform in a way that allows you to enter the sale amount and quickly receive the total tax due, including any additional local taxes. This is a practical solution for business owners who do not have the time or resources to research tax rates for every sale.

Another benefit of using a reliable sales tax calculator Nevada is compliance. Tax authorities expect businesses to report and pay the correct sales tax amounts. Errors in tax calculation can lead to fines and audits, which can be stressful and expensive. Otto AI’s Nevada sales tax calculator reduces this risk by providing precise tax figures, ensuring you stay compliant with Nevada's tax regulations. This tool is especially helpful during tax season when accurate reporting becomes even more critical.

Otto AI also understands that business owners want tools that are easy to use. The Nevada sales tax calculator is designed with a simple and clean interface where you just need to input the sale amount, select the location, and instantly get the total tax calculation. There are no complicated steps, no confusing forms, and no need to manually search for updated tax rates. The tool is perfect for self-employed professionals and entrepreneurs who want a hassle-free experience.

For businesses that handle a large volume of transactions daily, using a sales tax Nevada calculator like the one offered by Otto AI can improve workflow efficiency. Instead of spending valuable time calculating taxes manually or cross-checking rates for each city, you can rely on the calculator to give you accurate results every time. This not only speeds up your invoicing process but also ensures that your business records remain error-free and professional.

Moreover, Otto AI’s Nevada state sales tax calculator is a reliable choice for businesses that are expanding or handling online sales. When selling products across different regions of Nevada, applying the correct local tax rates becomes important. Otto AI’s tool automatically considers these local variations, making sure your tax calculations are always in line with Nevada's tax structure. This can save you from costly errors and help maintain your business's reputation for accuracy and reliability.

Managing sales tax does not have to be a complicated process. With the Nevada sales tax calculator, you can handle your tax obligations with ease and confidence. Otto AI ensures that its calculator stays updated with the latest tax rates, so you never have to worry about outdated figures affecting your business operations. Whether you are a solo entrepreneur or managing a small business team, having a dependable tax calculator by your side can significantly reduce the burden of tax compliance.

In conclusion, the Nevada Sales Tax Calculator is an essential tool for businesses looking to streamline their tax calculations and maintain accuracy in their records. Otto AI provides a simple yet powerful solution that takes care of the complexities involved in sales tax computations. By using this tool, business owners, self-employed professionals, and entrepreneurs can focus more on growing their business while staying compliant with Nevada’s tax laws. Otto AI’s Nevada sales tax calculator ensures that every transaction is calculated correctly, giving you peace of mind and saving you valuable time.