When running a business in Florida, understanding how much sales tax to collect and pay is a vital part of daily operations. For businesses of all sizes, especially for small business owners, freelancers, and entrepreneurs, calculating the correct sales tax is necessary to stay compliant with state regulations. The Florida Sales Tax Calculator can make this process much simpler, removing guesswork and ensuring that every transaction is handled accurately. Otto AI offers a reliable tool that helps in making sales tax calculations easy, saving time and avoiding costly mistakes.

Florida has a state sales tax rate of 6%, but in many locations, counties impose an additional discretionary sales surtax. This surtax varies depending on the county, which can make manual calculations challenging. Without a proper Florida sales tax calculator, businesses risk undercharging or overcharging customers. This is where an automated tool becomes a valuable asset. Instead of juggling with complex tax charts or manual formulas, the calculator instantly provides precise amounts for any sale value. This ensures businesses maintain accuracy and professionalism in every customer transaction.

For example, if a business in Miami-Dade County sells a product for $100, they need to apply both the state sales tax and the county surtax. A sales tax calculator for Florida automatically factors in these numbers, ensuring the business collects the correct total amount from the customer. It eliminates confusion and streamlines the entire billing process, which is especially important for those managing multiple sales daily.

One of the major advantages of using a Florida sales tax calculator is its ability to handle different types of sales, including in-store purchases, online orders, and special services. Each of these sales scenarios might have unique tax rules, but the calculator ensures compliance by adjusting figures based on the location and type of transaction. This feature is essential for businesses that operate across various counties in Florida where surtax rates differ. Entrepreneurs who use Otto AI’s calculator can rely on accurate, up-to-date tax computations without needing to study complex tax codes.

Another benefit is time efficiency. Manual tax calculations are not only prone to errors but also consume a lot of time, especially during busy business hours. A sales tax calculator for Florida simplifies this workload, allowing business owners and their teams to focus more on serving customers and growing the business. It reduces administrative stress and supports smoother financial operations. This becomes a critical factor for self-employed professionals who manage everything from sales to bookkeeping on their own.

Using a Florida tax calculator for sales is also helpful when filing sales tax returns. It ensures that the amounts recorded in business records are consistent and accurate, minimizing discrepancies that could lead to audits or penalties. Businesses can maintain better financial records and stay prepared for tax seasons without any last-minute scrambles. Otto AI’s tool provides businesses with the peace of mind that they are always in compliance with Florida’s tax regulations.

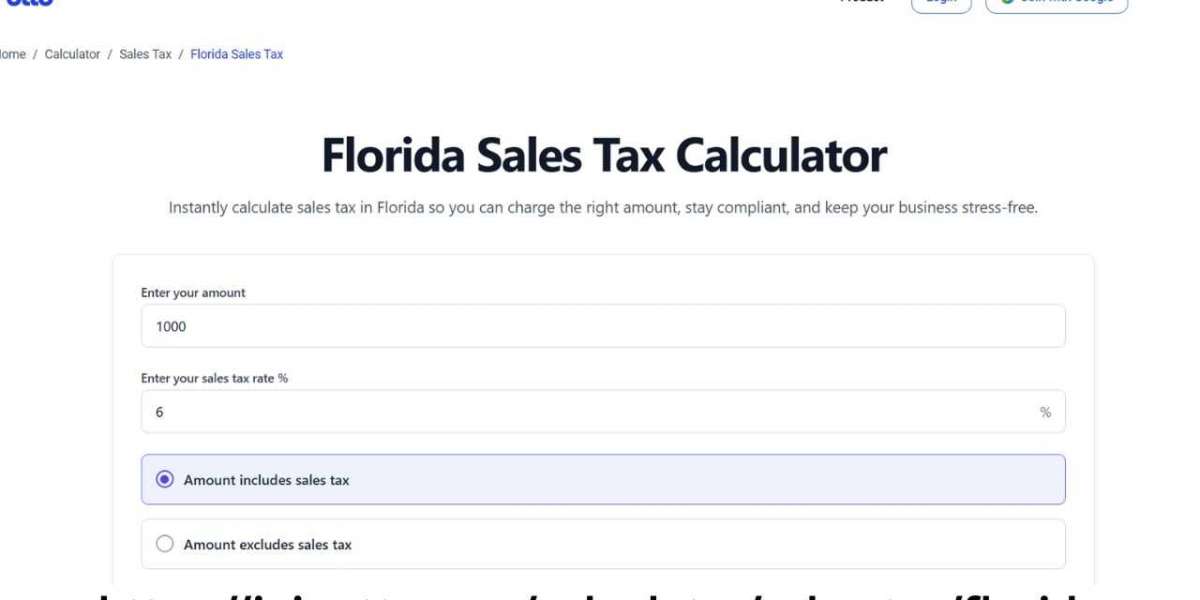

The Florida sales tax calculator is also highly user-friendly. Business owners don’t need to have an accounting background to use it effectively. With simple input fields for sale amounts and automatic application of the latest tax rates, the calculator provides results within seconds. This makes it an ideal solution for small retail shops, service providers, online sellers, and even mobile businesses like food trucks. Having quick and reliable access to accurate tax data helps businesses offer transparent pricing to their customers, building trust and professionalism.

In addition, the flexibility of the Florida sales tax calculator makes it suitable for various business models. Whether it’s a single-location boutique or a business with multiple branches across different counties, the calculator adjusts calculations accordingly. This flexibility ensures that businesses are charging the correct sales tax every time, no matter where the sale occurs. Entrepreneurs who aim to scale their business can rely on this tool to support them as they expand into new regions within Florida.

For service-based businesses, the sales tax application can be tricky as not all services are taxable. The calculator simplifies this by providing clear distinctions based on the service type and location. This accuracy is essential in maintaining customer satisfaction and preventing billing errors. Otto AI’s Florida sales tax calculator empowers service providers to confidently apply taxes where needed and skip them where they don’t apply, keeping business practices compliant and professional.

Moreover, the Florida sales tax calculator is a practical educational tool for business owners. By using it regularly, they become more familiar with Florida’s tax structure and county surtax variations. This knowledge helps them make informed pricing decisions and communicate clearly with their customers about the final amounts due. Over time, this builds confidence in handling business finances effectively.

In today’s fast-paced business environment, accuracy and efficiency in tax calculations are not just administrative tasks; they are critical components of customer satisfaction and regulatory compliance. The Florida sales tax calculator serves as a vital tool that supports both aspects. Otto AI ensures that small business owners, self-employed individuals, and entrepreneurs have access to a tool that simplifies tax processes while maintaining high accuracy standards.

In conclusion, the Florida Sales Tax Calculator is an essential asset for businesses aiming to streamline their sales tax processes. It eliminates the risk of errors, saves valuable time, and helps businesses stay compliant with Florida’s tax regulations. Otto AI’s solution offers a simple yet powerful tool that supports small business owners, entrepreneurs, and freelancers in handling their tax calculations with ease. For businesses in Florida looking to improve their transaction accuracy and financial operations, integrating a reliable sales tax calculator is a smart and necessary step.