Running a small business or working as a self-employed professional in Wyoming comes with many responsibilities, and managing your income is one of the most important. Understanding how much money you will actually take home after taxes and deductions can be challenging. A Wyoming Paycheck Calculator is a useful tool that helps you estimate your net pay accurately, making it easier to plan for both personal and business expenses.

Even though Wyoming does not impose a state income tax, federal taxes, Social Security, and Medicare contributions still reduce your paycheck. Using a Wyoming Paycheck Calculator allows you to include all of these factors as well as optional deductions like health insurance or retirement contributions. This ensures that you know your take-home pay and can budget effectively without surprises.

Consider John, a freelance web developer in Wyoming. He works with multiple clients, and his income varies each month. Before using a paycheck calculator, he often found himself unsure of how much money he would actually have after taxes. By using a Wyoming Paycheck Calculator, John could enter his earnings, federal tax status, and deductions, and instantly see his take-home pay. This helped him plan for business expenses, personal bills, and savings more confidently.

Gross income is the starting point in calculating your paycheck. This is the total amount you earn before deductions. A paycheck calculator subtracts federal income tax, Social Security, Medicare, and any voluntary contributions to show your net pay. For business owners like John, including health insurance or retirement deductions ensures a complete understanding of the actual money available. A Wyoming Paycheck Calculator provides transparency, helping you make informed financial decisions.

For small business owners and freelancers, income often fluctuates, making budgeting a challenge. A Wyoming Paycheck Calculator allows you to estimate take-home pay for different scenarios, helping you plan ahead for taxes, personal expenses, and business growth. John could enter projected earnings for upcoming months and adjust his spending, making sure he had enough for both business and personal needs.

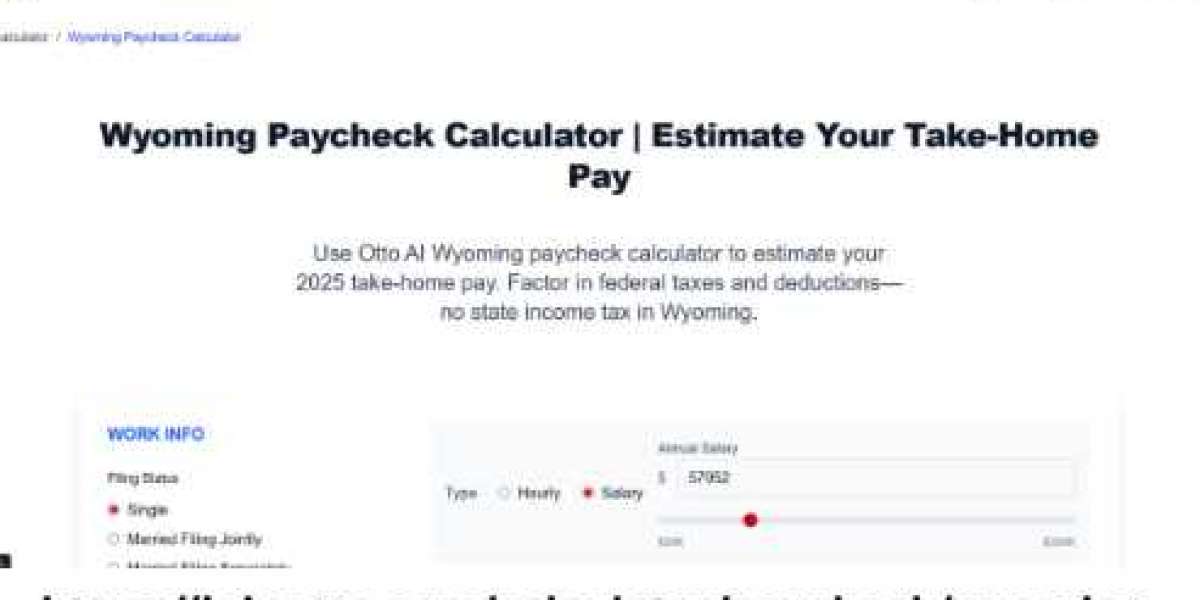

Payroll compliance is another critical reason to use a calculator. While Wyoming does not have state income tax, federal payroll requirements like Social Security and Medicare contributions must still be met. A Wyoming Paycheck Calculator ensures your payroll calculations are accurate, reducing the risk of errors and potential penalties. Tools like Otto AI’s Wyoming Paycheck Calculator save time while providing precise results, allowing entrepreneurs to focus on growing their business rather than manual payroll calculations.

A paycheck calculator also accommodates different pay schedules. Whether you are paid weekly, biweekly, or monthly, the tool adjusts the calculations accordingly. It can also handle overtime, bonuses, or commission-based earnings. This flexibility makes it ideal for small business owners and freelancers who may have variable income streams. By knowing your net pay for each pay period, you can plan ahead with confidence.

Understanding take-home pay helps you manage both personal and business finances. By knowing exactly how much money you will receive, you can allocate funds for expenses, savings, and business investments. A Wyoming Paycheck Calculator provides a detailed breakdown of deductions, so you can see where your money is going. This level of clarity reduces financial stress and supports smarter budgeting.

Manual payroll calculations are prone to mistakes and can be time-consuming. Tax rates change, deductions may vary, and each paycheck can have unique factors. Using a Wyoming Paycheck Calculator eliminates errors and provides accurate results in minutes. John no longer had to worry about miscalculating his take-home pay, saving him both time and stress.

Freelancers and self-employed professionals also benefit from using a paycheck calculator for planning purposes. By entering projected income and deductions, you can estimate take-home pay Wyoming under various scenarios. This helps you manage irregular income, avoid cash flow problems, and stay prepared for quarterly taxes or unexpected expenses.

Accurate payroll also fosters trust with employees or contractors. Timely and correct payments reflect professionalism and reliability. Using a Wyoming Paycheck Calculator ensures everyone receives the correct amount, reducing disputes and strengthening relationships. This simple tool allows small business owners to maintain accuracy and professionalism without investing in complex payroll systems.

Self-employed entrepreneurs also gain insight into their financial health by understanding take-home pay. Knowing your net income helps you plan rates, set aside money for taxes, and manage savings. A Wyoming Paycheck Calculator provides the clarity needed to make informed decisions for both short-term and long-term goals. John used his calculator to evaluate different income scenarios and plan for growth, which improved his business stability.

In conclusion, a Wyoming Paycheck Calculator is an essential tool for small business owners, freelancers, and self-employed professionals. It simplifies payroll calculations, provides a clear view of deductions, and helps calculate take-home pay Wyoming accurately. Tools like Otto AI’s Wyoming Paycheck Calculator save time, reduce errors, and give entrepreneurs confidence in managing their finances. By using this tool, you can plan your income wisely, stay compliant with federal requirements, and focus on growing your business with stability.