For small business owners and self-employed entrepreneurs, understanding your earnings after taxes is essential. Every dollar counts when managing both personal and business finances. Using a Wisconsin Paycheck Calculator can help you calculate take-home pay Wisconsin accurately, making financial planning much easier and reducing unexpected surprises.

A paycheck calculator Wisconsin takes into account all the elements that affect your net income. When you enter your gross pay, it deducts federal and state taxes, Social Security, Medicare, and other contributions such as retirement plans or health insurance. This gives a clear estimate of the money that actually reaches your bank account, helping you plan daily expenses, savings, and investments.

One of the biggest advantages of using a Wisconsin Paycheck Calculator is convenience. Calculating taxes manually can be time-consuming and prone to mistakes, especially for entrepreneurs and freelancers with varying income levels. With the calculator, all the complex math is done automatically, giving you accurate results in seconds. This allows you to focus on running your business instead of worrying about tax calculations.

Flexibility is another key benefit. Whether you receive payments weekly, bi-weekly, semi-monthly, or monthly, the calculator can adjust to match your pay schedule. This makes it useful not only for self-employed professionals but also for business owners managing employees. Accurate payroll estimates ensure compliance with federal and state tax regulations and prevent costly errors.

Beyond taxes, a paycheck calculator can include additional deductions that impact your take-home pay. Contributions to retirement accounts, health savings accounts, or other voluntary programs are accounted for, offering a realistic view of your net earnings. For entrepreneurs, this clarity helps in planning budgets for both business and personal needs, avoiding surprises when funds are limited.

Using a paycheck calculator Wisconsin can also help in learning how different deductions and tax scenarios affect your income. Adjusting variables such as retirement contributions, number of dependents, or additional withholdings immediately shows how these changes impact your take-home pay. Over time, this knowledge helps small business owners and self-employed individuals make smarter financial decisions.

Freelancers and entrepreneurs with irregular income benefit the most from this tool. Predicting take-home pay for projects, seasonal work, or varying client payments can be difficult. A Wisconsin Paycheck Calculator provides consistent estimates, helping you manage cash flow, plan for large expenses, and save for taxes efficiently.

Another important advantage is reducing stress during tax season. Many self-employed professionals struggle with calculating estimated taxes, but using a paycheck calculator makes it simpler. By knowing how much to set aside for federal and state taxes each month, you can avoid surprises and penalties. This ensures financial stability and peace of mind throughout the year.

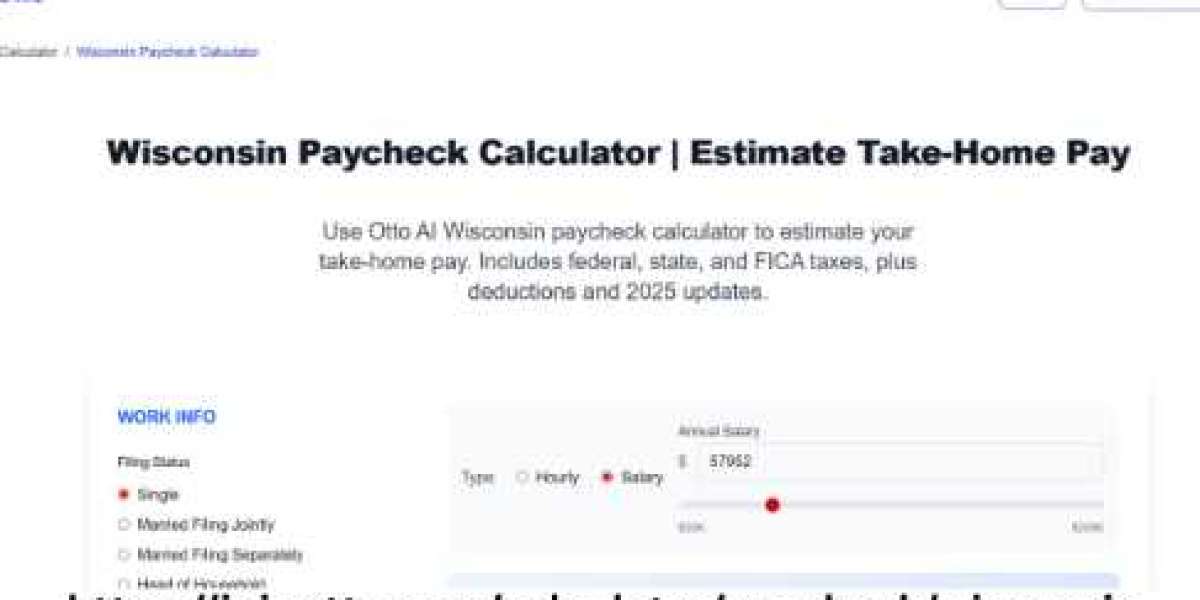

Tools like Otto AI’s Wisconsin Paycheck Calculator combine simplicity with accuracy. Even without a background in accounting, you can quickly estimate take-home pay. This accessibility is especially valuable for small business owners and freelancers who handle their finances independently. It allows them to focus on business growth while maintaining control over personal and professional finances.

A paycheck calculator also helps in planning for business growth and lifestyle changes. Estimating the impact of hiring staff, increasing your salary, or changing business expenses ensures informed financial decisions. Accurate net pay calculations support better cash flow management, enabling small business owners to plan investments, savings, and other financial goals confidently.

In conclusion, a Wisconsin Paycheck Calculator is a practical tool for anyone who wants clarity and accuracy in their earnings. It allows small business owners and self-employed professionals to calculate take-home pay Wisconsin efficiently, accounting for taxes and other deductions. With resources like Otto AI, estimating net income becomes easier, saving time and reducing stress. Integrating a paycheck calculator into your routine ensures smarter financial planning, better payroll management, and overall financial stability. Using this tool is a step toward controlling your finances and making informed decisions for both business and personal growth.