IMARC Group has recently released a new research study titled “Mexico Oral Care Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico Oral Care Market Overview

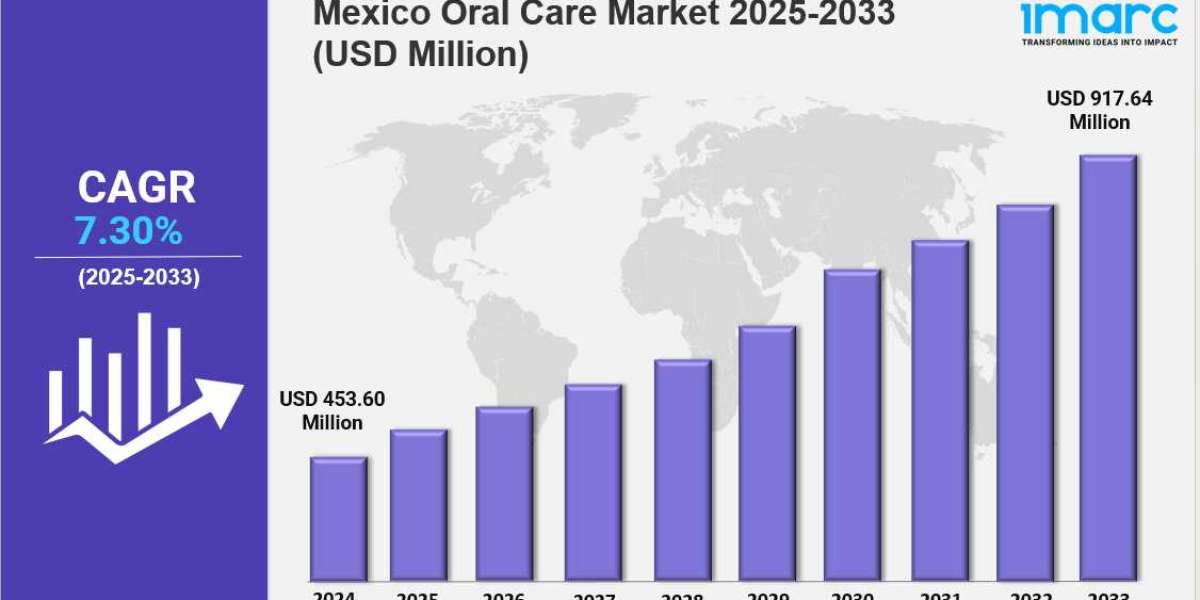

The Mexico oral care market size reached USD 453.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 917.64 Million by 2033, exhibiting a growth rate (CAGR) of 7.30% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 453.60 Million

Market Forecast in 2033: USD 917.64 Million

Market Growth Rate 2025-2033: 7.30%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-oral-care-market/requestsample

Key Market Highlights:

✔️ Increasing focus on dental hygiene driven by growing awareness and urbanization

✔️ Rising demand for herbal, natural, and whitening oral care products

✔️ Expansion of e-commerce channels boosting product accessibility and consumer reach

Mexico Oral Care Market Trends

The Mexico Oral Care Market is experiencing a significant transformation driven by rising disposable incomes, evolving consumer lifestyles, and growing awareness of dental hygiene. According to the latest both multinational corporations and local startups are reshaping their product offerings to meet changing consumer needs. Urban centers such as Mexico City, Monterrey, and Guadalajara are witnessing strong for premium and advanced products.

Premium Products and Urban Demand

- Sales of electric toothbrushes have surged by 27% annually as professionals and millennials seek better oral health solutions.

- Enamel-repair toothpaste with nano-hydroxyapatite has created a MXN 2.1 billion niche segment.

- Leading players like Colgate-Palmolive and Procter Gamble are investing in innovative products, further strengthening the Mexican Oral Care Market Growth outlook.

Regional Disparities Affecting Mexico Oral Care Market Size

Despite robust growth in urban regions, rural Mexico continues to face challenges. Only 12% of villages have consistent access to advanced oral care products due to distribution gaps. This uneven accessibility impacts the overall Mexican Oral Care Industry Size, restricting the availability of modern solutions to millions of consumers.

To counter this, the government introduced the Salud Bucal 2025 initiative, which aims to distribute 500,000 electric toothbrushes to low-income households.

Eco-Friendly Innovations Driving Market Trends

Sustainability is emerging as a strong trend in the Mexico Oral Care Market Report. Nearly 68% of consumers now prefer eco-friendly packaging and natural formulations. Brands like BioMint and VerdeSonrisa are capitalizing on this demand with bamboo toothbrushes and aloe vera-based toothpaste, recording 90% annual growth.

Colgate’s recyclable toothpaste tubes and the 2024 COFEPRIS ban on microplastics in floss are reshaping product innovation. Still, shortages of organic ingredients and higher costs (15–20% price hikes) challenge affordability.

Mexico’s USD 1.8 billion dental tourism industry is a major driver of premium oral care product demand. In 2024, more than 1.2 million patients from the U.S. and Canada visited cities like Tijuana and Los Algodones, fueling sales of whitening kits and remineralizing creams.

Dental clinics now bundle luxury oral care kits priced up to MXN 2,499, while TikTok’s #SonrisaPerfecta trend created a MXN 650 million whitening market segment. However, safety concerns remain as many whitening products sold online contain illegal peroxide levels.

Traditional Remedies and Cultural Influence

The Mexico Oral Care Market Demand is also shaped by cultural practices. Traditional remedies using chicle, guayaba bark, and herbal rinses remain popular, especially in rural regions. Brands such as Herbolaria, which integrate traditional herbs with modern formulations, reported 150% sales growth in 2024.

Government Regulations and Public Health Efforts

The Mexican government continues to support better oral care access. The Ley General de Salud Bucal, passed in 2024, mandates the addition of fluoride in public water supplies—a move expected to reduce cavity rates by 30% within the next decade. Such initiatives are highlighted in every major as crucial growth enablers.

Economic and Climate Challenges Impacting the Market

Income inequality remains a challenge in the Mexico Oral Care Market Forecast. Households in the top 10% income bracket spend nearly MXN 1,200 per month on oral care, compared to MXN 180 for lower-income groups. Climate change is also creating new health risks, such as reduced saliva production due to high temperatures in states like Sonora and Chihuahua.

E-commerce is becoming a vital channel, with platforms like Mercado Libre contributing 38% of oral care product sales. This digital shift is expected to remain central to the Mexico Oral Care Market Forecast, particularly among younger, tech-savvy consumers.

Mexico Oral Care Market Forecast and Future Outlook

The Mexico Oral Care Market Forecast projects the industry to surpass USD 3.4 billion in the coming years, supported by eco-conscious innovation, dental tourism, and government-backed healthcare programs. The Mexico Oral Care Market Demand will remain strong across premium and affordable product categories, ensuring inclusive long-term growth.

Conclusion

The Mexico Oral Care Industry Report highlights a sector defined by urban demand, sustainable innovation, and cultural influence. Despite challenges in rural accessibility, pricing, and product safety, the remains optimistic. With strong demand, regulatory support, and technological advances, the Mexico Oral Care Market is well-positioned for sustained growth.

Mexico Oral Care Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Product Type:

- Toothpaste

- Toothbrush

- Mouthwash

- Others

Breakup by Application:

- Household

- Commercial

Breakup by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Sales Channels

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Ask Analyst Browse Full Report with TOC List of Figures: https://www.imarcgroup.com/request?type=reportid=36565flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302