What Is C Corporation Tax Preparation and Why It Matters?

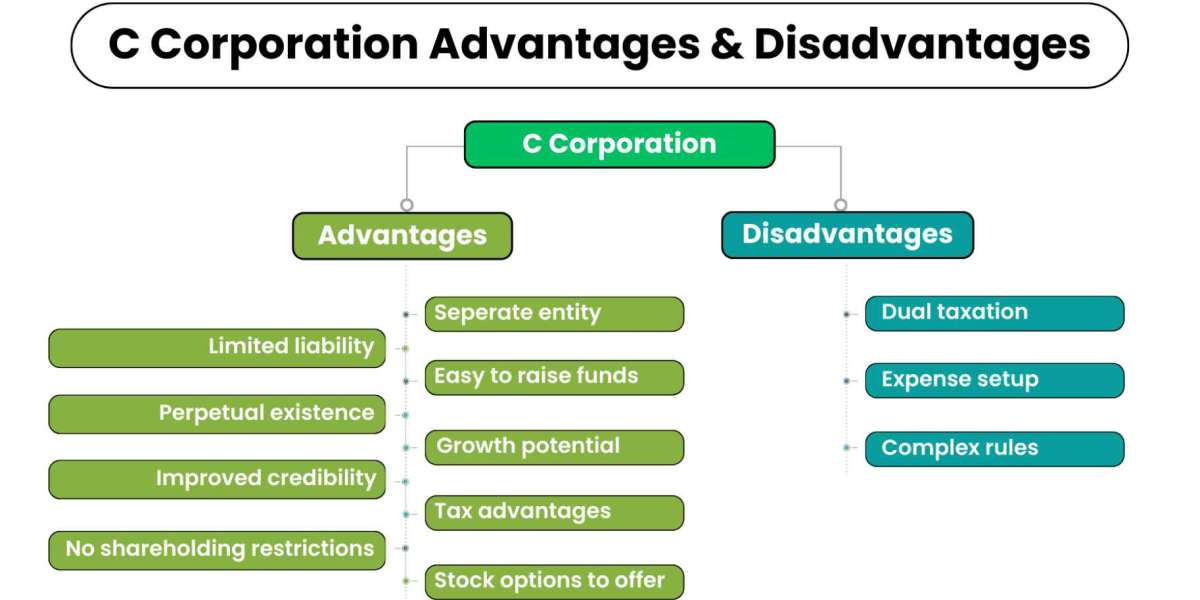

C Corporation tax preparation encompasses the comprehensive process of organizing financial records, calculating corporate taxable income, and ensuring timely submission of all required tax documents to federal, state, and local authorities. Unlike other business entities, C Corporations face unique double taxation challenges and must navigate complex regulatory requirements that demand expert attention.

The stakes are significant: corporate tax compliance failures can result in severe penalties, audit triggers, and reputational damage that undermines stakeholder confidence. With the IRS collecting approximately $428 billion in corporate taxes annually, proper preparation ensures your business contributes appropriately while maximizing available deductions.

Essential Components of C Corporation Tax Compliance:

Year-Round Financial Documentation

Successful C Corp tax preparation requires systematic record-keeping throughout the fiscal year, including:

- Income tracking: Comprehensive documentation of all revenue sources, sales transactions, and business receipts

- Expense categorization: Detailed records of deductible business expenses, employee compensation, and operational costs

- Asset management: Proper documentation of depreciation schedules, capital investments, and property acquisitions

- Inter-company transactions: Accurate reporting of related-party dealings and transfer pricing documentation

Form 1120 Filing Requirements:

The Form 1120 U.S. Corporation Income Tax Return serves as the primary filing document for C Corporations, requiring:

- Balance sheet information: Complete financial position statements showing assets, liabilities, and equity

- Income statement details: Comprehensive profit and loss documentation with supporting schedules

- Tax calculation worksheets: Accurate computation of federal tax liability using current rates and regulations

- Supporting schedules: Additional forms addressing specific corporate activities and transactions

Multi-Jurisdictional Compliance:

C Corporations operating across state lines must navigate varying tax regulations and filing requirements:

- State tax obligations: Individual state corporate income tax returns with jurisdiction-specific requirements

- Local tax compliance: Municipal and county tax filings where business operations occur

- Interstate commerce regulations: Proper allocation and apportionment of income across multiple jurisdictions

How Professional Tax Preparation Strengthens Compliance?

Deadline Management and Filing Accuracy:

Professional C Corporation tax services ensure critical deadlines are met consistently. The standard filing deadline—the 15th day of the 4th month following the fiscal year-end—must be observed to avoid automatic penalties that can reach thousands of dollars.

Expert preparers maintain sophisticated tracking systems that monitor:

- Federal and state filing deadlines

- Extension requirements and limitations

- Estimated tax payment schedules

- Quarterly compliance obligations

Advanced Deduction Optimization:

C Corporations qualify for numerous tax deductions that require expert identification and documentation:

- Employee compensation: Salaries, benefits, and retirement plan contributions

- Business operational expenses: Office rent, utilities, professional services, and equipment costs

- Research and development credits: Specialized incentives for innovation and technology investments

- Section 199A deductions: Manufacturing and production activity benefits where applicable

Risk Mitigation and Audit Defense:

Professional tax preparation significantly reduces audit risk through:

- Comprehensive documentation: Detailed supporting records that satisfy IRS examination requirements

- Compliance verification: Multiple review layers ensuring accuracy before submission

- Position support: Strong legal and factual foundation for all tax positions taken

- Representation services: Expert advocacy during IRS interactions and examinations

Technology Integration in Modern Tax Preparation:

Automated Compliance Systems

Leading tax management software streamlines the compliance process through:

- Data consolidation: Automated gathering of financial information from multiple sources

- Real-time calculations: Instant computation of tax liabilities and estimated payments

- Error detection: Advanced algorithms identifying potential compliance issues before filing

- Document management: Centralized storage and organization of supporting documentation

Enhanced Reporting Capabilities:

Modern tax preparation platforms provide advanced analytics that help corporations:

- Identify potential tax savings opportunities

- Monitor compliance metrics across multiple jurisdictions

- Generate detailed reports for stakeholder review

- Track regulatory changes affecting tax obligations

Strategic Benefits Beyond Compliance:

Investor Confidence and Financing Access

Accurate tax compliance directly impacts business growth opportunities:

- Due diligence readiness: Clean compliance records expedite investment negotiations

- Lending qualification: Banks require documented tax compliance for business financing

- Stakeholder transparency: Professional filings demonstrate operational sophistication

- Market credibility: Compliance strength enhances competitive positioning

Long-Term Financial Planning:

Strategic tax preparation enables proactive business planning:

- Cash flow optimization: Accurate tax projections improve working capital management

- Strategic decision support: Tax implications inform major business decisions

- Growth planning: Compliance foundation supports expansion initiatives

- Risk management: Proper preparation minimizes unexpected tax liabilities

Choosing the Right C Corporation Tax Preparation Approach:

In-House vs. Outsourced Services

Many corporations leverage professional tax services to ensure optimal compliance:

Professional advantages include:

- Current expertise: Tax professionals maintain up-to-date knowledge of regulatory changes

- Specialized experience: Industry-specific understanding of complex tax issues

- Resource efficiency: Outsourcing allows internal teams to focus on core business activities

- Liability protection: Professional services often include errors and omissions coverage

Service Selection Criteria:

When evaluating C Corp tax preparation services, consider:

- Industry experience: Proven track record with similar corporations

- Technology capabilities: Modern systems ensuring accuracy and efficiency

- Compliance guarantees: Service level commitments and professional liability coverage

- Advisory services: Strategic tax planning beyond basic compliance

2025 Compliance Outlook and Preparation:

Regulatory Evolution

The corporate tax landscape continues evolving with:

- Digital reporting requirements: Increased emphasis on electronic filing and data transparency

- Enhanced scrutiny: IRS focus on corporate compliance verification

- International regulations: Growing complexity of cross-border tax requirements

- ESG considerations: Environmental, social, and governance factors affecting tax strategy

Preparation Strategies:

Effective C Corporation tax preparation in 2025 requires:

- Early planning: Year-round preparation rather than year-end scrambling

- Technology adoption: Leveraging automation for accuracy and efficiency

- Professional partnerships: Engaging qualified experts for complex compliance issues

- Continuous monitoring: Regular review of regulatory changes affecting obligations

Conclusion:

C Corporation tax preparation represents far more than regulatory compliance—it's a strategic business function that protects against risk while enabling growth opportunities. Through systematic preparation, professional expertise, and technology integration, corporations can transform tax compliance from a burden into a competitive advantage.