The Financial Hurdle in Marketing

Marketing agencies deal with diverse clients, multiple campaigns, and fluctuating budgets. While creativity drives this industry, financial management often becomes a major challenge. Late client payments, unpaid invoices, and scattered vendor expenses can disrupt operations.

That’s why many marketing companies are turning to accounts receivable outsourcing services. By outsourcing receivables, agencies can improve collections, reduce delays, and maintain a steady flow of income.

Why Accounts Receivable Outsourcing Services Matter

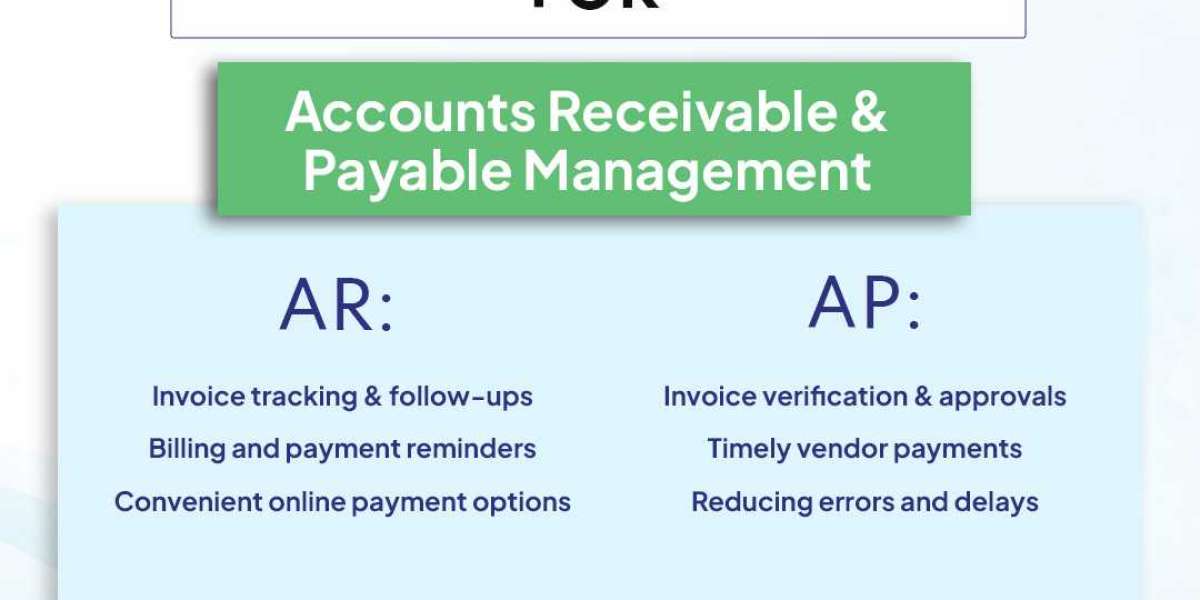

Managing accounts receivable in-house can be time-consuming and costly. When agencies use accounts receivable outsourcing services, they gain:

- Faster Collections: Timely follow-ups to reduce overdue invoices.

- Improved Accuracy: Professional teams ensure invoices are error-free.

- Cash Flow Stability: Payments are received consistently, supporting campaigns and payroll.

- Focus on Creativity: Teams can dedicate more time to clients instead of chasing payments.

Outsourcing not only reduces stress but also brings structure and reliability to financial operations.

Role of Online Accounts Payable Services

Just as receivables are important, payables also play a crucial role. Agencies must handle vendor payments for ad platforms, freelancers, and third-party services. With online accounts payable services, marketing companies can:

- Pay vendors on time.

- Avoid duplicate or missed payments.

- Streamline expense tracking.

- Reduce manual paperwork.

Together, receivable outsourcing and online payable services create a balanced financial system that supports both incoming and outgoing transactions.

How Accounts Receivable SaaS Helps Agencies

Modern marketing firms rely on technology to stay competitive. By adopting accounts receivable SaaS, businesses gain access to:

- Automated invoicing and reminders.

- Real-time tracking of pending payments.

- Cloud-based access for teams across locations.

- Data-driven insights for better decision-making.

When combined with outsourcing, SaaS tools provide agencies with a scalable, transparent, and reliable financial management system.

Benefits for Marketing Businesses

- Consistent cash flow to manage campaigns.

- Reduced administrative costs.

- Strong vendor relationships through timely payments.

- More time to focus on clients and creative strategies.

About IBN Technologies

IBN Technologies specializes in helping businesses like marketing agencies manage finances effectively. With expert accounts receivable outsourcing services, they ensure timely collections and improved reporting. Their online accounts payable services support smooth vendor management, while advanced tools like accounts receivable SaaS provide efficiency and transparency.

IBN empowers marketing companies to focus on innovation and client success while maintaining financial health.

Conclusion

In the marketing industry, financial stability is just as important as creativity. By using accounts receivable outsourcing services, agencies can streamline collections and improve cash flow. Pairing these with online accounts payable services and adopting accounts receivable SaaS creates a complete solution for managing both revenue and expenses.

For marketing businesses, outsourcing is more than convenience—it’s a strategy to ensure growth, efficiency, and long-term success.