The Global biosensors market has experienced remarkable growth, driven by several factors, including the increasing demand for point-of-care testing (POCT), advancements in technology, and a greater emphasis on healthcare diagnostics. The global market value was estimated at USD 7.50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.40% during the forecast period of 2024-2032. By the end of the forecast period, the market is projected to reach a value of USD 13.11 billion. This growth is being fueled by factors like an aging population, increased chronic disease prevalence, and the growing awareness of the importance of early diagnosis and preventive care.

In this article, we will explore the drivers, trends, challenges, segmentation, and competitive landscape of the biosensors market, as well as provide answers to frequently asked questions (FAQs) and an overview of key players in the industry.

Market Overview

What Are Biosensors?

Biosensors are analytical devices used to detect biological substances, such as glucose, pathogens, or other biomarkers, through the interaction of a biological component with a sensor element. The biological component, typically an enzyme, antibody, or nucleic acid, interacts with the target substance to produce a measurable signal. This signal is then translated into data that can be interpreted for diagnostic or monitoring purposes.

Biosensors play a pivotal role in healthcare by enabling quick, efficient, and accurate testing. They are widely used in diagnostics, food safety, environmental monitoring, and bioprocessing, among other applications.

Get a Free Sample Report with Table of Contents : https://www.expertmarketresearch.com/reports/biosensors-market/requestsample

Market Drivers

1. Increasing Demand for Point-of-Care Testing (POCT)

One of the major drivers of the biosensors market is the growing demand for point-of-care testing. Point-of-care testing refers to diagnostic testing conducted outside of traditional laboratory settings, often at the patient’s bedside or in outpatient clinics. The demand for POCT has risen due to its convenience, fast turnaround time, and cost-effectiveness, especially in managing chronic diseases, diabetes, and cardiovascular conditions.

With the growing trend of home healthcare and remote monitoring, the need for portable and user-friendly biosensors is more critical than ever. This is expected to boost the adoption of biosensors in the market.

2. Technological Advancements

The development of advanced biosensors with enhanced sensitivity, selectivity, and miniaturization has also driven market growth. Innovations such as wearable biosensors, continuous glucose monitors, and lab-on-chip technologies have made significant strides in improving patient outcomes by offering real-time, continuous data on vital health parameters. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in biosensor technologies is enabling more accurate diagnoses and predictive capabilities.

3. Growing Healthcare Needs and Awareness

As the global population ages and the incidence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases increases, there is a greater need for diagnostic tools that allow for early detection and continuous monitoring. Biosensors, with their ability to provide real-time data, have emerged as a crucial solution in this regard.

The awareness of the benefits of early diagnosis and preventive healthcare has also led to increased demand for biosensors in both clinical and home settings.

4. Rising Healthcare Expenditure

Governments and private sectors across the globe are increasingly investing in healthcare technologies. With a shift towards preventive care and early diagnosis, biosensors are being adopted as part of healthcare initiatives that aim to reduce the burden of chronic diseases and improve overall healthcare outcomes.

Market Trends

1. Integration with Wearables

Wearable biosensors are gaining significant traction as they provide continuous, real-time health data. These devices are capable of monitoring various physiological parameters, such as glucose levels, heart rate, oxygen saturation, and more, all of which can be easily accessed through mobile applications. This trend is expected to drive the adoption of biosensors, particularly among consumers who are becoming more proactive about their health.

2. Personalized Medicine

With the advancement of personalized medicine, there is a growing emphasis on customized treatment plans based on individual biomarkers. Biosensors are a crucial part of this movement, providing real-time data to enable tailored treatments and monitoring. This has further spurred demand for biosensors, particularly in areas such as oncology, diabetes management, and cardiovascular disease.

3. Non-invasive Testing

There is a shift towards non-invasive biosensors, especially for glucose monitoring. Traditional glucose testing requires blood samples, but with the advent of non-invasive biosensors, patients can now monitor glucose levels without the need for needles or blood draws. This development is expected to lead to greater adoption of biosensors, especially among diabetic patients who require continuous glucose monitoring.

4. Environmental and Food Safety Applications

Apart from healthcare, biosensors are being increasingly used in environmental and food safety monitoring. For instance, biosensors can detect pathogens in water, food products, and air, helping in quality control and ensuring public safety. The growing emphasis on food safety regulations is expected to further drive the adoption of biosensors in these areas.

Market Challenges

1. High Costs of Biosensor Development

Despite the rapid advancements in biosensor technologies, the high cost of research and development remains a significant challenge. The production of highly sensitive, accurate, and portable biosensors requires significant investments in materials and manufacturing processes. As a result, the cost of biosensor devices can be prohibitive, particularly for emerging markets.

2. Regulatory Hurdles

The regulatory landscape for biosensors, particularly in healthcare, is complex and varies across regions. Obtaining regulatory approvals for new biosensor technologies can be time-consuming and expensive, which may hinder the rapid adoption of novel biosensors. Regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) have stringent requirements for biosensor approval, making it challenging for new players to enter the market.

3. Data Privacy and Security Concerns

With the increasing integration of biosensors in digital health platforms, concerns related to data privacy and security have become more prominent. Personal health data generated by biosensors is highly sensitive, and there are growing concerns about potential data breaches and misuse. To address these concerns, biosensor manufacturers must invest in robust cybersecurity measures to protect user data.

Segmentation

The global biosensors market can be segmented based on type, technology, application, and end-use.

1. By Type

- Wearable Biosensors: These biosensors are gaining popularity due to their continuous monitoring capabilities and ease of use. They are mainly used for chronic disease management, such as diabetes and heart disease.

- Non-wearable Biosensors: These are typically used in laboratory settings for diagnostic purposes. They are often employed in medical diagnostics, environmental testing, and food safety.

2. By Technology

- Electrochemical Biosensors: These are the most common type of biosensors, offering high sensitivity and ease of use. They are widely used for glucose monitoring and other diagnostic applications.

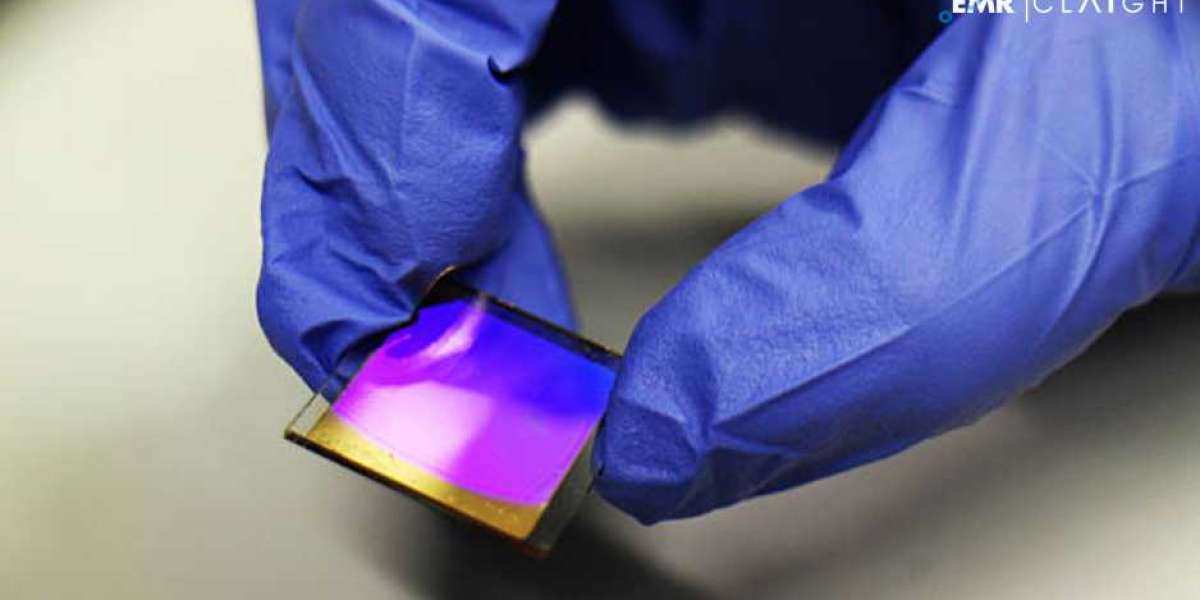

- Optical Biosensors: Optical biosensors use light to detect the presence of biological molecules. They are used in clinical diagnostics and environmental monitoring.

- Piezoelectric Biosensors: These biosensors detect changes in mass or force and are used in applications such as pathogen detection and environmental monitoring.

3. By Application

- Medical Diagnostics: This is the largest application segment, driven by the growing demand for point-of-care testing and continuous monitoring for chronic conditions.

- Environmental Monitoring: Biosensors are used to detect pollutants, pathogens, and toxins in water, air, and soil.

- Food and Beverage Safety: Biosensors are used for detecting contaminants in food products, ensuring safety and compliance with health regulations.

4. By End-use

- Healthcare: The healthcare sector is the largest end-user of biosensors, owing to the increasing adoption of wearable devices, home care devices, and diagnostic tools.

- Food and Beverage: Biosensors are used in the food industry to detect pathogens and ensure the safety of products.

Competitive Landscape

The global biosensors market is highly competitive, with several key players leading the way. Some of the key players include:

- Abbott Laboratories (Headquartered in Illinois, USA): Abbott is a leading global healthcare company that develops and manufactures a range of diagnostic tools, including biosensors for point-of-care testing.

- Medtronic plc (Headquartered in Dublin, Ireland): Medtronic offers a wide array of medical devices, including glucose monitoring biosensors and other healthcare solutions.

- Siemens Healthineers (Headquartered in Erlangen, Germany): Siemens Healthineers develops biosensors for clinical diagnostics, focusing on laboratory and point-of-care solutions.

- Dexcom, Inc. (Headquartered in California, USA): Dexcom is a leader in continuous glucose monitoring systems, which rely on advanced biosensor technology.

FAQs

Q1: What are the different types of biosensors?

Biosensors can be classified into various types, such as electrochemical biosensors, optical biosensors, and piezoelectric biosensors. Each type uses a different method to detect biological substances and convert the signals into measurable data.

Q2: How are biosensors used in medical diagnostics?

Biosensors are widely used in medical diagnostics for conditions like diabetes, cardiovascular diseases, and infectious diseases. They enable point-of-care testing, continuous monitoring, and early detection of health conditions.

Q3: What are the challenges faced by the biosensors market?

Challenges include high development costs, regulatory hurdles, and data privacy concerns. These factors may limit the widespread adoption of biosensors, especially in emerging markets.

Q4: How does the increasing demand for point-of-care testing impact the biosensors market?

The growing demand for point-of-care testing has significantly contributed to the biosensors market's growth. Point-of-care testing provides rapid results and allows for early detection and management of health conditions, driving the adoption of biosensors in medical settings.