You are responsible for guaranteeing the accuracy and completeness of the proof documents. The DMV will review them to confirm that you meet the state's insurance requirements. If everything is in order, you'll receive confirmation that your SR22 insurance is active, and you can resume driving (insurance carriers). It's essential to keep track of the proof verification process, as any errors or omissions can delay the activation of your SR22 insurance. By submitting the correct proof documents, you can guarantee a smooth verification process and get back on the road safe

You'll find that SR22 coverage typically doesn't cover other drivers, it's tied to SR22 drivers, and you're responsible for ensuring they're insured when driving your vehicle, checking policy terms is essential. - licens

Financial stability: Can the provider pay out claims?

Customer reviews: What do other customers say about their experience?

Coverage options: Does the provider offer the coverage you need?

Getting Discounted Rat

SR22 insurance proves minimum required coverage.

Filings are required after serious traffic violations.

Tennessee SR22 laws mandate 3-5 year coverage.

High-risk drivers can find specialized insurance providers.

Shopping around helps save on SR22 premium

Provider financial stability and ratings

Coverage options and policy customization

Claims processing and customer service

Discounts and loyalty programs

Provider reputation and reviews from other customers

You compare these factors to find the provider that best meets your safety needs and budget. By carefully evaluating provider benefits and coverage options, you can make an informed decision and choose the best SR22 insurance provider for your situation. This helps guarantee you have the protection you need while driving in Tennessee.

(Tennessee SR22 Insurance)

Cost Comparis

You'll find that SR22 insurance TN coverage typically doesn't cover other drivers, it's tied to SR22 drivers, and you're responsible for ensuring they're insured when driving your vehicle, checking policy terms is essential. - licens

n Liability Coverage

Covers damages to others in an accident

All-encompassing Insurance

Covers non-accident related damages to your vehicle

Collision Insurance

Covers damages to your vehicle in an accident

Personal Injury Protection

Covers medical expenses for you and your passenge

SR22 insurance proves minimum required coverage.

Filings are required after serious traffic violations.

Tennessee SR22 laws mandate 3-5 year coverage.

High-risk drivers can find specialized insurance providers.

Shopping around helps save on SR22 premium

Tennessee's insurance laws require drivers to carry specific types of coverage, which can be confusing to maneuver. You need to understand the different types of insurance to guarantee you're adequately covered. Liability coverage is a must, as it protects you in case you're involved in an accident. All-encompassing insurance is also essential, as it covers damages to your vehicle that aren't related to accidents, such as theft or vandalis

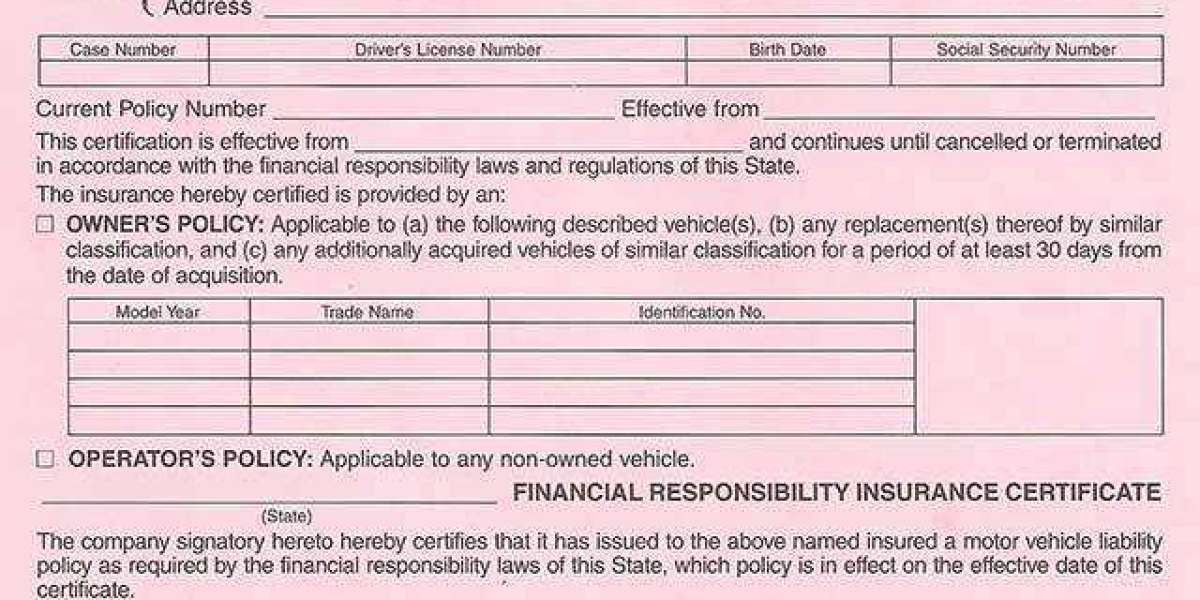

One key step in obtaining SR22 insurance in Tennessee - SR22 insurance quotes TN is filing the SR22 form with the state's Department of Motor Vehicles. You'll need to submit this form to prove you have the required insurance coverage. The SR22 filing process typically involves your insurance provider filing the form on your behalf. You're responsible for ensuring the form is filed correctly and that you understand the legal requiremen

When you're labeled as a high-risk driver, finding affordable insurance can be challenging, but you have options. You can investigate different insurance providers that specialize in high-risk insurance. licensed. These providers offer various plans and rates, so it's crucial to compare them to find the best fit for y

You steer roads like a ship through stormy seas, seeking motorcycle coverage, and you'll find SR22 insurance is required for high risk riders, ensuring safety on two wheels, you'll comply. - SR22 insurance quotes

You can get SR22 without a car by meeting SR22 requirements, exploring SR22 alternatives like non-owner policies, which provide coverage when driving others' vehicles, reducing liability risks. - licens

Your driving record - SR22 insurance quotes TN and insurance history play a significant role in determining your SR22 insurance rates in Tennessee. You'll want to implement high risk strategies to minimize your rates. Consider taking driver education courses to improve your driving skills and knowledge. This can help you become a safer driver and reduce your insurance cos

As a high-risk driver, you'll likely face higher premium rates. However, shopping around and comparing rates from different insurance providers can help you find more affordable options. Consider factors like coverage options, deductibles, and discounts when selecting a high-risk insurance plan. By doing your research, you can make an informed decision and choose the best insurance provider for your needs. his response. This helps you maintain safety on the road while managing your insurance cos

noemiharitos3

1 Blog Mesajları