In Forex, the spread is the difference between the buy and sell prices of a currency pair. In Forex trading, an investor buys a currency pair if its price is expected to rise or sells a currency pair if its price is expected to fall. The spread is considered a trading cost, and it is inherent in CFD and Forex trading. You can read about it in this article. - https://forexone.club/en/education/forex-the-role-of-spread-in-trading When trading, a trader always “sells” a currency in which he has long positions and “buys” a currency in which he has short positions. Thus, when buying, the trader takes the bid price and when selling, the trader takes the ask price.

Meaning of Spread

The spread can be measured in “pips” - the smallest unit of change in the price of a currency pair. For major currency pairs, a pip can be the fourth decimal place of the currency pair. Thus, the spread is the difference between the buy price at the fourth decimal place and the sell price at the fourth decimal place. For example, a Forex broker can buy a currency pair at the price of 1.0872 and sell the same pair at the price of 1.0874. The spread in this case is 2 points.

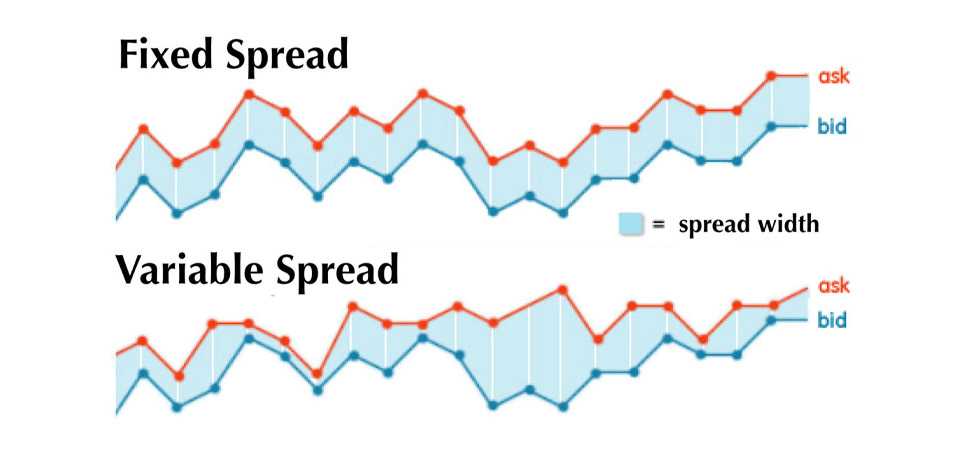

As a rule, the spread on a currency pair is constant, and a trader knows the value of a deal before it is concluded. Thus, the spread is expressed as the bid price subtracted from the ask price. A narrow spread is attractive to traders as it gives a higher rate of profit. Online Forex brokers often advertise the narrow spreads they offer as it is considered a competitive advantage. A wide spread can be disadvantageous to the trader as it reduces the possible profit from the trade.

Conclusion

It is important to note that the spread is not the only cost of trading and traders should be aware of other costs such as commissions, swaps and slippage. It is also important to note that the spread is always reflected in the price quotes of the currency pair at the broker. The spread can be variable or fixed, depending on the broker and the type of account the trader is using. Traders should be aware of these differences before choosing a broker and account type. Overall, understanding the spread is fundamental to understanding the value of Forex trading.