Investing in US stocks from India is a smart way to diversify your portfolio and gain exposure to some of the world’s largest and most influential companies. This guide explains the methods, costs, and key factors to consider when investing in US stocks.

Ways to Invest in US Stocks from India

1. Direct Investments

Open an Overseas Trading Account with an Indian Broker

Many Indian brokers collaborate with US brokers, allowing you to trade US stocks directly. Here’s how it works:

- Process: Provide the required documents for identity verification and follow the broker’s account setup process.

- Considerations: Be mindful of higher costs, such as brokerage fees and currency conversion charges. Check the types of investments allowed and any restrictions on the number of trades.

Open an Account with a Foreign Broker

You can also open an account directly with foreign brokers like Charles Schwab, Ameritrade, or Interactive Brokers.

- Process: Sign up with the broker, complete the verification process, and start trading.

- Considerations: Understand all fees, including account maintenance, transaction costs, and currency conversion charges.

2. Indirect Investments

If you prefer not to open an overseas trading account, you can invest in US stocks indirectly through the following options:

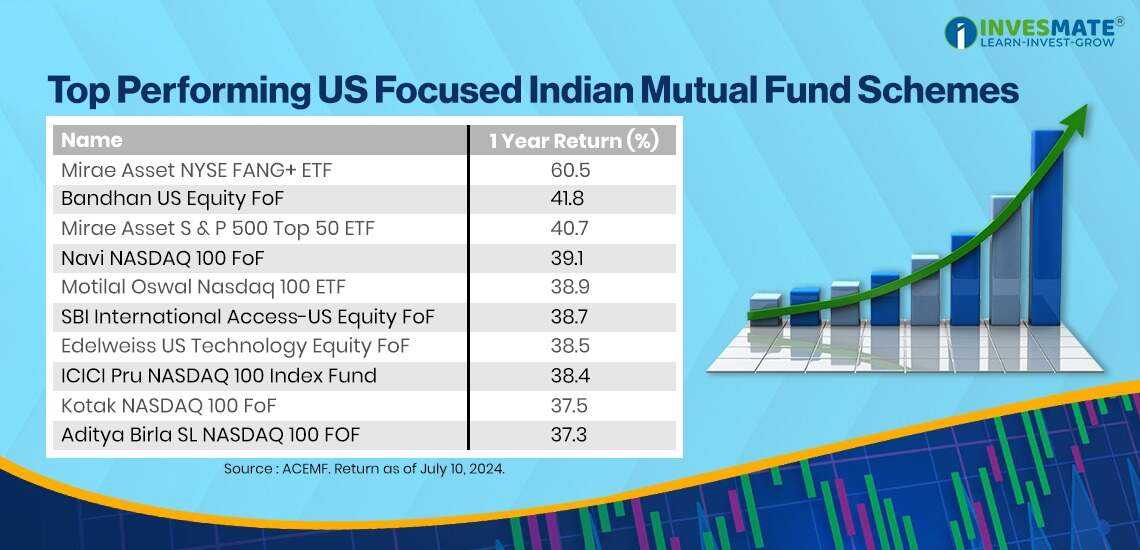

Mutual Funds

Invest in Indian mutual funds that hold US stocks. For example, the DSP US Flexible Equity Fund provides exposure to US markets without the need for a foreign account.

ETFs

Exchange-Traded Funds (ETFs) are another way to access US markets. You can either:

- Buy US ETFs via a broker.

- Invest in Indian ETFs tracking international indices, such as the Motilal Oswal Nasdaq 100 ETF.

Modern Investment Apps

Several start-ups and financial platforms offer apps that simplify investing in US stocks. These apps may restrict intraday trading due to regulations. Examples include INDmoney and other modern platforms.

Costs Involved in Investing in US Stocks

Understanding the costs is crucial before investing. Here are the key expenses to consider:

1. Tax Collected at Source (TCS)

- A 5% TCS applies to remittances exceeding ₹7 lakh under the RBI’s Liberalized Remittance Scheme (LRS).

- You can claim this amount as a refund when filing your income tax return.

2. Taxes on Capital Gains and Dividends

- US Taxes: Dividends are taxed at 25% in the US for Indian residents. However, under the Double Taxation Avoidance Agreement (DTAA), you can claim tax credit in India.

- Indian Taxes: While there’s no capital gains tax in the US, you must pay tax on capital gains in India.

3. Bank Charges

Fees for currency conversion and fund transfers may apply, along with potential one-time setup charges.

4. Brokerage Fees

Brokers charge fees for buying and selling shares. These vary depending on the platform you use.

5. Foreign Exchange Rates

The exchange rate at the time of purchase or withdrawal impacts your investment costs and returns.