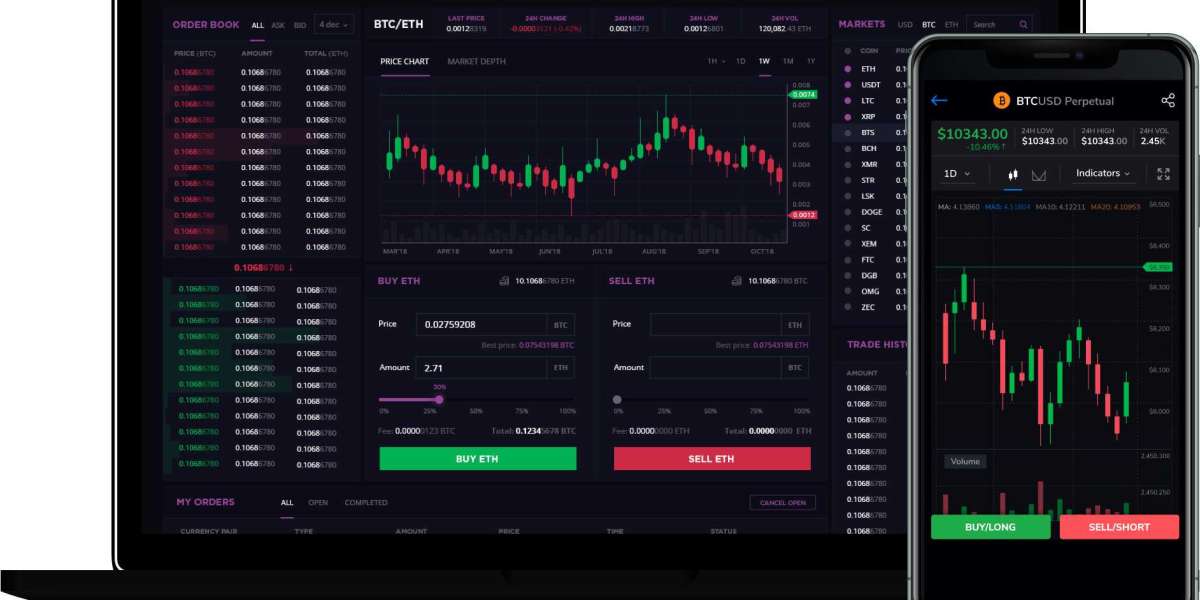

Crypto derivatives exchanges have gained significant traction in the digital asset space, providing traders with advanced financial instruments to hedge risks and maximize profits. Developing a crypto derivatives exchange platform offers several benefits for both platform owners and users.

- Higher Profit Potential

Derivatives trading often involves leverage, allowing users to trade with a fraction of the total investment. This results in higher trading volumes, increasing revenue for the exchange through fees and commissions. - Market Liquidity Improvement

Derivatives trading attracts institutional and retail investors, enhances overall market liquidity. A highly liquid market ensures smooth trade execution with minimal slippage. - Risk Management for Traders

Crypto derivatives enable traders to hedge their positions against market volatility. With options like futures and perpetual contracts, investors can mitigate risks and stabilize their portfolios. - Competitive Edge in the Crypto Industry

A well-built derivatives exchange can differentiate itself by offering unique trading features like perpetual contracts, leverage options, and advanced risk management tools, attracting a broader user base. - Increased Institutional Adoption

Institutions prefer derivatives for their ability to manage risks efficiently. Offering a secure and regulatory-compliant derivatives platform can draw institutional investors, boosting credibility and growth.

By developing a robust and secure crypto derivatives exchange platform, businesses can tap into a lucrative market, drive user engagement, and establish a strong foothold in the evolving crypto ecosystem.

![Vilitra 20 mg: Get Vardenafil [20%OFF] | Reviews | Dosage | Best Quality](https://youslade.com/upload/photos/2023/03/WbwKIZXF7SREj9jX5lwC_13_82d01b265b7b8d42c214a88bac110662_image.png)