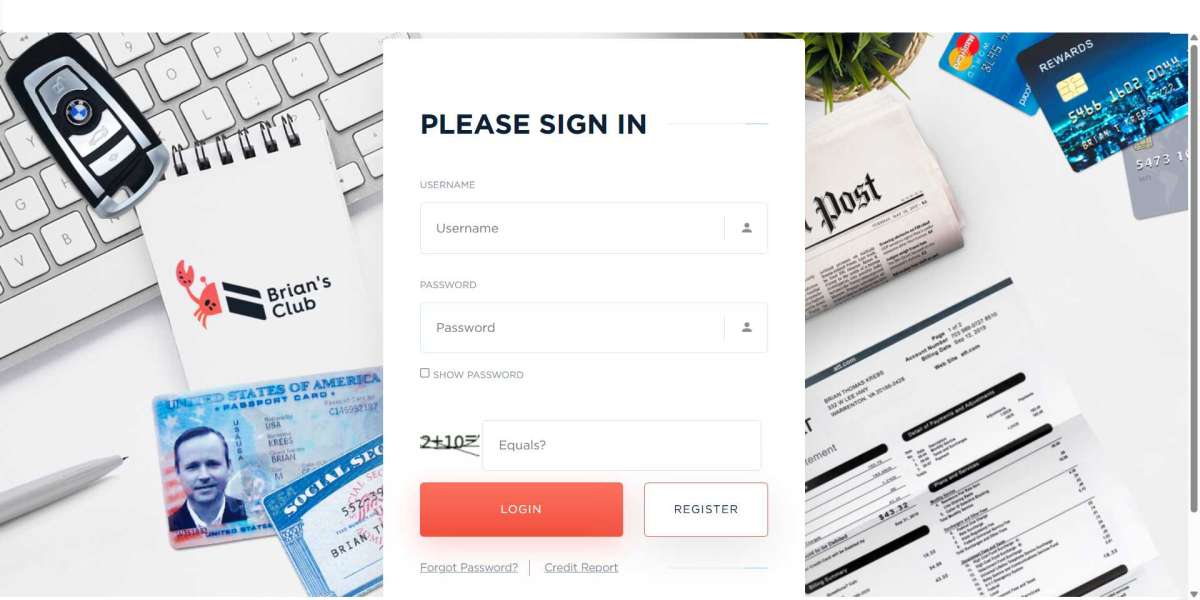

In the ever-evolving landscape of online transactions, terms like "Bclub," "dumps," and "CVV2 shops" often surface, leaving many curious about their implications. When discussing credit cards, it’s essential to understand these terms and how they relate to the broader world of digital finance.

Bclub is associated with a marketplace where individuals look for specific types of credit card data. This data typically includes information that can grant unauthorized access to someone else's financial resources. A "dump" refers to the raw data extracted from a credit card's magnetic strip. This information is often stolen through various means, including hacking, phishing, or physical skimming devices.

CVV2, stored on the back of a credit card, is another piece of information that fraudsters seek. This three-digit security code is crucial for online transactions as it adds an additional layer of security. When combined with the card number and expiration date, the CVV2 code allows someone to make a purchase without the physical card.

Understanding these terms is essential for anyone navigating the world of online payments. While many people are unaware of such dark corners of the internet, it’s crucial to recognize the risks that come with unsecured transactions and the potential for identity theft. The increasing sophistication of cybercriminals means individuals must take proactive steps to protect themselves.

For instance, using a credit card with strong security features, regularly monitoring account statements, and employing two-factor authentication can make a significant difference in safeguarding personal financial information. Moreover, educating oneself about the potential threats associated with Bclub and similar entities can empower consumers to make informed decisions about their online purchasing habits.

In conclusion, while Bclub, dumps, and CVV2 shops can sound daunting, knowledge is the key to protection. By staying informed about these terms and understanding the implications of credit card security, consumers can take control of their financial safety. Rather than succumbing to fear, it’s essential to harness this knowledge to build a secure online environment for transactions. Always prioritize security and stay vigilant to protect your financial well-being in the modern digital landscape.