Ø Technological Integration: Blockchain platforms are providing growth in market size for asset tokenization through secure and efficient management of transactions.

Ø Real Estate Opportunities: Tokenization is rapidly transforming the nature of real estate since it allows ownership of the property in part, thus increasing the float.

Ø Regulatory Evolution: Clarity on the changing regulations and interpretations is creating market confidence and pushing for growth and innovation in the tokenization of assets across the globe.

Ø Increased Investor Access: Through fractional ownership of tokens, retail investors are increasing the market share of the markets making the markets more democratic and populous.

Ø Strategic Partnerships: This makes it easy for the companies to partner with financial institutions and technology providers for the integration of tokenized assets into traditional systems and in turn expand the market even further.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/asset-tokenization-market?popup=report-enquiry

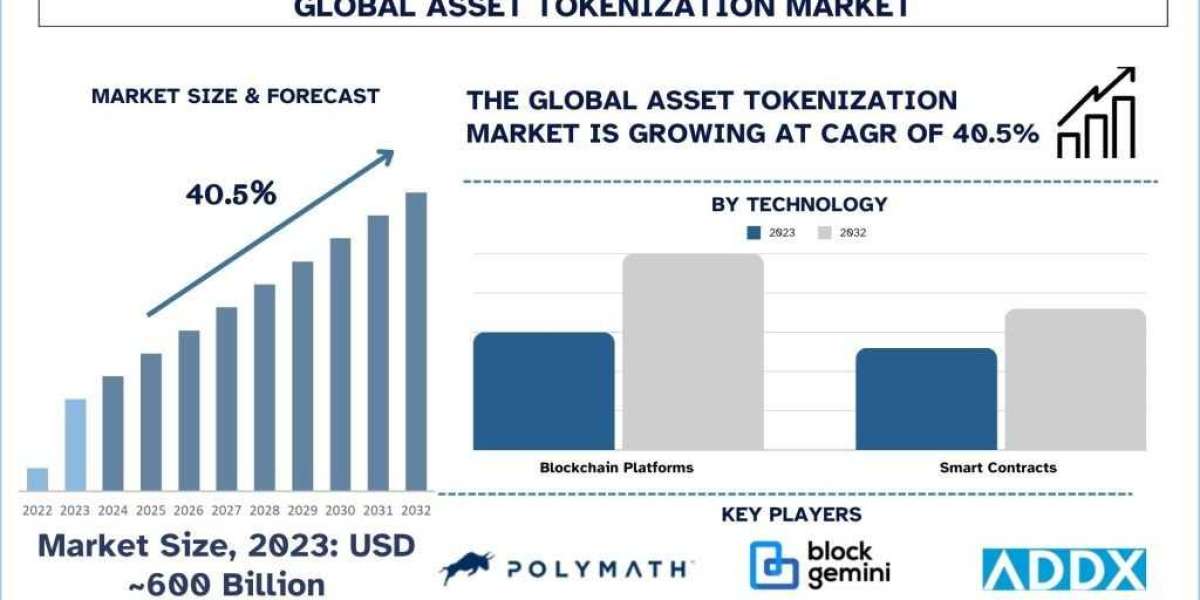

According to a new report by UnivDatos, the Asset Tokenization market is expected to reach USD Billion in 2032 by growing at a CAGR of 40.5%. This is mainly due to the asset tokenization growth being highly stable due to the developing worlds of blockchain and smart contracts, the need for liquidity in various industries, as well as the changing legislation that has adopted digital asset exchanges. For instance, in July 2024, RACE, a pioneering full-stack modular blockchain infrastructure platform, announced the mainnet launch of its Ethereum Layer 2 (L2) blockchain, specifically designed for tokenizing and distributing real-world assets (RWAs). Built on Optimism’s OP Stack, a leading Ethereum scaling solution, RACE’s new blockchain has joined Optimism’s Superchain, alongside OP Mainnet and Base. This integration promises enhanced asset interoperability, speed, and safety for its users. These factors combined lead to market growth and mean that asset tokenization is becoming the driving force in the financial and investment industries.

Here are five examples of government regulations, laws, and legal frameworks that influence the Asset Tokenization market:

Regulatory Considerations

Navigating Compliance in Asset Tokenization

In the rapidly evolving landscape of asset tokenization, regulatory considerations stand as a cornerstone, shaping the framework, operations, and integrity of tokenized assets. As assets are transformed into digital tokens and traded on blockchain platforms, adherence to regulatory standards, securities laws, and compliance protocols becomes paramount. By navigating the complex regulatory landscape, asset tokenization can unlock its transformative potential, fostering transparency, trust, and legitimacy in the global financial ecosystem.

The Regulatory Landscape of Asset Tokenization:

Securities Laws and Regulations: Tokenized assets representing ownership interests in companies, funds, or investment vehicles may be classified as securities and subject to securities laws and regulations. Regulatory compliance entails proper registration, disclosure requirements, investor accreditation, and adherence to securities offering rules, ensuring transparency, fairness, and compliance with regulatory standards.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Compliance with AML and KYC regulations is crucial in mitigating risks of illicit activities, fraud, and financial crimes in asset tokenization. Market participants, including token issuers, exchanges, and service providers, must implement robust AML and KYC protocols, conduct due diligence, verify customer identities, and monitor transactions to detect and prevent suspicious activities, safeguarding the integrity and reputation of tokenized asset markets.

Related Reports

Aviation Asset Management Market: Current Analysis and Forecast (2022-2028)

Asset and Wealth Management Market: Current Analysis and Forecast (2022-2028)

Asset Performance Management Market: Current Analysis and Forecast (2022-2030)

Asset Tokenization Market: Current Analysis and Forecast (2024-2032)

According to the report, the impact of asset tokenization has been identified to be high for the Asia-Pacific area. Some of how this impact has been felt include:

Asset tokenization is steadily rising in the Asia-Pacific area, primarily because the governments of Singapore, Hong Kong, and Japan are introducing blockchain into their economies. For instance, on 27 June 2024, The Monetary Authority of Singapore (MAS) announced the expansion of initiatives to scale asset tokenization for financial services. This includes partnering with global industry associations and financial institutions to drive common asset tokenization standards in fixed income, foreign exchange (FX), and asset wealth management. The region has also embraced the use of digitalization and has friendly laws that support the use of digital assets, hence promoting the market. Thus, using asset tokenization, companies are applying new sources of financing and increasing the demand for assets in non-standardized and illiquid market segments. They are also using technological applications to tackle local regulations to enhance transactional efficiency. Frequent partnerships with local banks and technological companies are encountered, as they work on creating proper solutions for different classes of assets. The increasing focus on fintech improvement and government encouragement of digitalization also help to propel the asset tokenization market in this area.

Contact Us:

UnivDatos

Contact Number - +19787330253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/