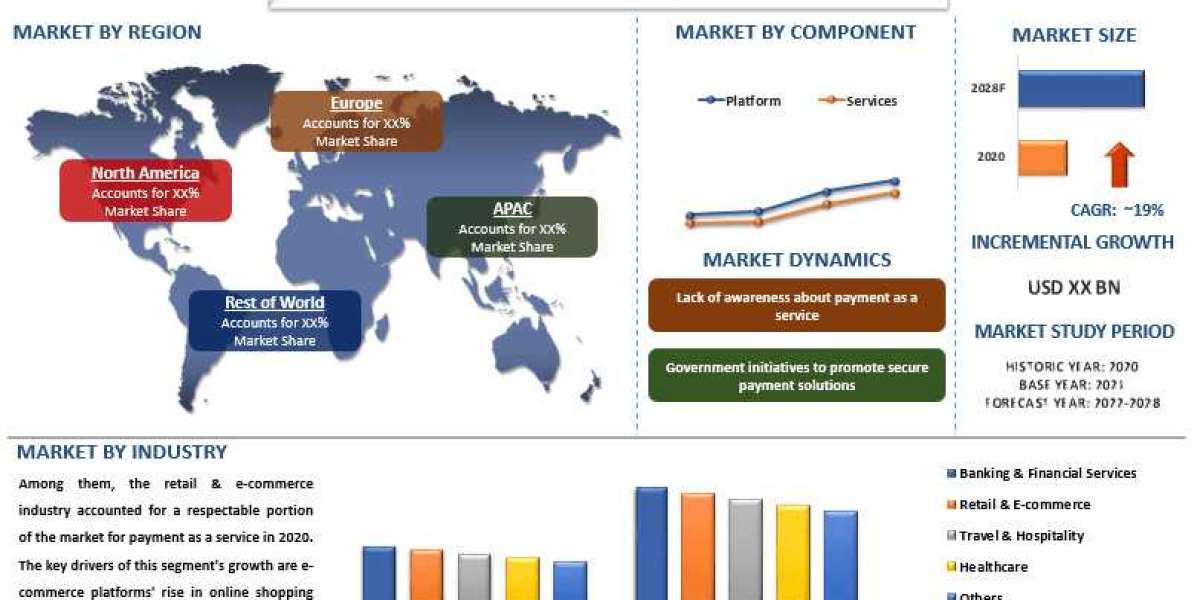

According to a new report published by UnivDatos, the Payment as a Service Market is expected to grow at a CAGR of around 19% from 2022-2028. The analysis has been segmented into Component (Platform and Services [Professional Services and Managed Services]); Industry (Banking Financial Services, Retail E-Commerce, Travel Hospitality, Healthcare, and Others); Region/Country.

For instance, according to India Brand Equity Foundation (IBEF), Indian e-commerce is projected to increase from 4% of the total food and grocery, apparel, and consumer electronics retail trade in 2020 to 8% by 2025.

The payment as a service market report has been aggregated by collecting informative data on various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the payment as a service market. The payment as a service market report offers a detailed analysis of the latest industry developments and trending factors in the market that are influencing the market growth. Furthermore, this statistical market research repository examines and estimates the payment as a service market at the global and regional levels.

Market Overview

Payment as a service is a marketing term used to describe software as a service that connects a group of international payment systems. The architecture is represented by a layer or overlay on top of these disparate systems, enabling bi-directional communication between payment systems and payment as a service. As a platform, payment as a service offers many benefits to many banks, financial institutions, and other organizations across the payments value chain. This makes adopting a payment as a service platform a very viable option for companies looking to reduce current operating costs and develop applications for the first time or those with limited resources. Furthermore, the rapidly growing e-commerce industry and the growing investments in cloud computing and artificial intelligence are other factors driving the growth of the payment as a service market. For instance, according to the Organization for Economic Co-operation and Development (OECD), Global spending on AI is forecast to double over the next four years, growing from USD 50.1 Bn in 2020 to more than USD 110 Bn in 2024.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/payment-as-a-service-market?popup=report-enquiry

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the payments as a service industry due to the increased use and acceptance of online and digital payment methods among consumers worldwide. Additionally, payment as a service is experiencing significant growth as consumers become more familiar with payment technology in the market.

The global payment as a service market report is studied thoroughly with several aspects that would help stakeholders in making their decisions more curated.

· Based on component, the market is bifurcated into platform and services. The services segment is further bifurcated into professional services and managed services. Amongst platform and services, the platform segment catered to a significant share of the market in 2020. The payment platform's ability to protect consumers' sensitive payment information is a key driver of the growth of the segment. Evolving customer-centric models are making businesses more eager to improve services and set up digital platforms to increase sales

· By industry, the market is categorized into banking financial services, retail e-commerce, travel hospitality, healthcare, and others. Among these, the retail e-commerce segment captured a commendable share of the payment as a service market in 2020. The rapid increase in online shopping through e-commerce platforms and increasing internet connectivity are the main factors supporting the growth of this segment. Payment as a service allows retailers and online merchants to accept payments from their customers in a variety of ways, including digital wallets, internet banking, and credit/debit cards.

Click here to view the Report Description TOC- https://univdatos.com/reports/payment-as-a-service-market

Have a Look at the Chapters

Payment as a Service Market Geographical Segmentation Includes:

· North America (U.S., Canada, and the Rest of North America)

· Europe (Germany, U.K., France, Italy, Spain, and the Rest of Europe)

· Asia-Pacific (China, India, Japan, and the Rest of Asia-Pacific)

· Rest of the World

The Asia-Pacific payment as a service market held a dominating share of the global payment as a service market in 2020. The regional expansion can be attributed to vigorous activities being pursued by various governments to promote digitalization and stimulate the adoption of digital payment technology. The expansion of the local market is also anticipated to be aided by ongoing investments in the e-commerce sector.

Related Report

MENA Card Payment Market: Current Analysis and Forecast (2023-2030)

Global Digital Payment Market: Current Analysis and Forecast (2020-2026)

MasterCard Market: Current Analysis and Forecast (2022-2030)

Middle East Buy Now Pay Later Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +19787330253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/