Unexpected refinery outages in December, such as ExxonMobil's Baytown complex, could jeopardize supply in 1QFY22. Spot export prices are expected to pick up in the new year, as supply-side constraints coupled with higher demand from Europe are expected to improve arbitrage on the U.S. side in the coming weeks.

The Brazilian fuel market has been on an upward trend since June 2021, staying above pre-pandemic levels. In its November 2021 Brazil Short-Term Fuel Market Outlook, EPE forecast diesel sales to grow by 7.6%, gasoline by 7.9% and jet fuel by 23%. For 2022, the EPE sees a recovery in economic activity that will drive increased use of petroleum products and biofuels in Brazil. Jet fuel prices are expected to rise 31%.

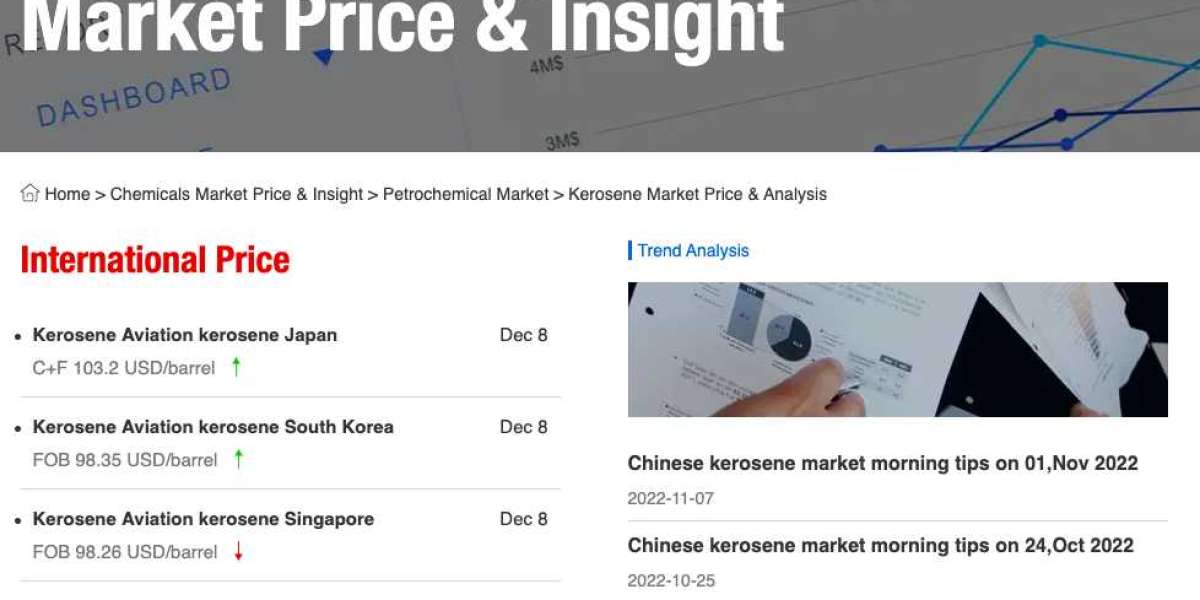

Demand for aviation kerosene in Asian countries has fluctuated with the recovery of the aviation industry after the COVID-19 crisis. Demand from the Indian aviation industry has improved significantly, supporting prices across the country. Kerosene prices in India rose 9.9% in the third quarter as crude oil prices rebounded. Usage among Asians varied by country in the third quarter of this year. In the second quarter of 2021, China's domestic aviation kerosene consumption will increase significantly. Meanwhile, in India, jet fuel use in India has fallen sharply during this period due to the sudden introduction of COVID restrictions following the country's second pandemic wave. However, prices continued to rise amid global pressure. As a result, kerosene prices in India rose from $967.6/ton to $1072.2/ton in the third quarter.

Industrial activity picked up in the third quarter, boosting the global aviation sector, including in India. While India's aviation industry recovered strength in the third quarter following the disruption caused by the second wave of COVID, prices remained within bounds. In India, jet fuel prices rose in late August and eventually stabilized at $627/t in September.