In an unpredictable financial world, there are few assets that offer the same level of stability and long-term security as gold. The Buy 1g Gold Bar Royal Mint is a shining example of this timeless commodity, providing investors with a practical and secure option to diversify their portfolios. Whether you’re a seasoned investor or a beginner looking to safeguard your wealth, this small yet powerful asset brings forth numerous advantages.

In this article, we’ll delve into why the 1g gold bar Royal Mint remains a sought-after investment, exploring its value, historical significance, and why it’s a wise addition to your financial strategy.

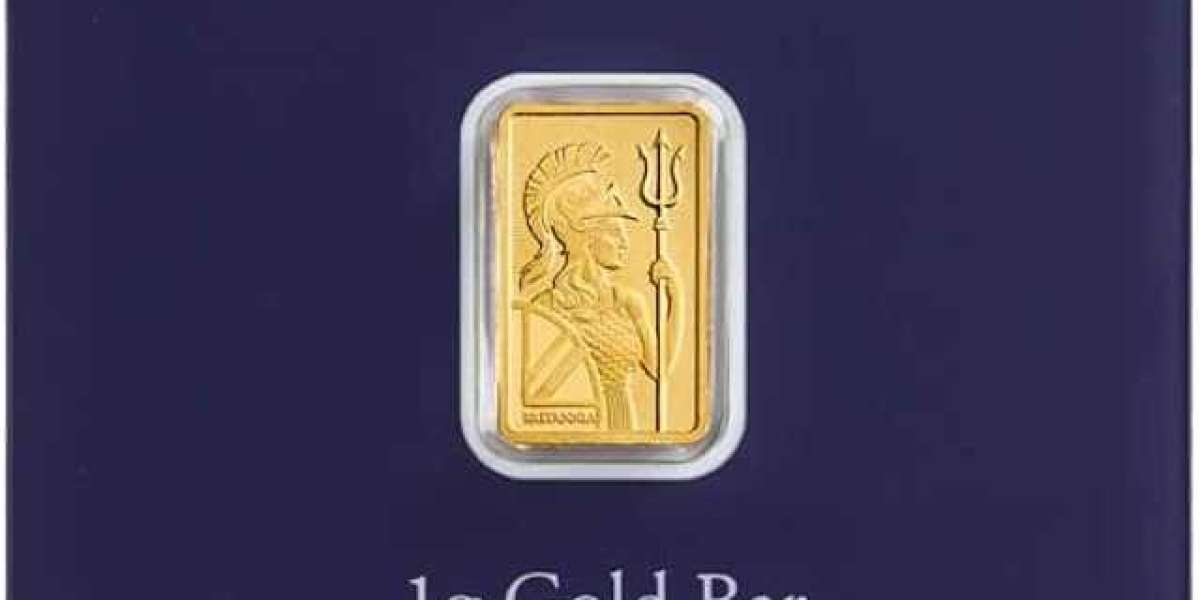

A Trusted Symbol of Quality and Craftsmanship

The Royal Mint, with its centuries-long heritage, is one of the most esteemed mints globally. Known for producing official coinage for the United Kingdom and countless other prestigious metal products, the 1g gold bar Royal Mint benefits from this longstanding reputation for quality. Each bar is meticulously crafted from 999.9 fine gold, ensuring both purity and reliability.

When you decide to buy a 1g gold bar Royal Mint, you are investing in a product that has undergone rigorous quality checks, guaranteeing it meets the highest standards in the industry. The Royal Mint's hallmark, prominently displayed on each bar, affirms its authenticity and gives investors confidence in their purchase.

Gold as a Safe Haven Asset

Gold has been regarded as one of the safest forms of investment for centuries. Throughout history, it has served as a hedge against inflation, economic instability, and currency devaluation. The 1g gold bar Royal Mint offers the same advantages in a compact, easily accessible form. Unlike stocks or bonds, which are subject to market fluctuations and economic shifts, gold remains a stable and resilient asset.

During times of geopolitical unrest, economic downturns, or market volatility, gold often retains or even increases in value, making it an excellent asset for hedging against risk. By buying a 1g gold bar Royal Mint, investors are ensuring their wealth is protected from the uncertainties of the financial world.

Accessibility for All Investors

One of the most attractive aspects of the 1g gold bar Royal Mint is its affordability and accessibility. While larger gold bars may require significant capital investment, the 1g gold bar Royal Mint is a much more approachable option for smaller investors. With a smaller investment, you can begin building a portfolio of gold, gradually accumulating value over time.

This accessibility makes the 1g gold bar Royal Mint an excellent starting point for those new to gold investing. It provides a low-risk, manageable entry into the world of precious metals without the need for substantial upfront investment. Moreover, its small size makes it easy to store and secure, whether at home, in a safe deposit box, or in a professional storage facility.

Liquidity and Flexibility

Gold is universally recognized and accepted, which makes it a highly liquid asset. When you buy a 1g gold bar Royal Mint, you are purchasing a product that can be easily sold or traded at any time. Whether you decide to sell it in the future or use it as collateral for a loan, gold retains its value across markets, offering unparalleled flexibility.

Unlike other forms of investment, such as real estate or stocks, which may take time to liquidate, gold provides immediate access to cash when needed. The 1g gold bar Royal Mint offers the same advantages in terms of liquidity, allowing investors to quickly convert their holdings into cash if required.

An Investment with Historical Significance

Gold’s intrinsic value is based on its scarcity, durability, and timeless appeal. Throughout history, it has been revered as a symbol of wealth and prosperity. The 1g gold bar Royal Mint is more than just a financial asset—it represents a piece of history. As a tangible asset, gold can be passed down through generations, preserving wealth and legacy.

By purchasing the 1g gold bar Royal Mint, you are connecting with a tradition that has lasted for thousands of years. This gold bar serves as both an investment and a piece of heritage, providing future generations with a store of value that is as relevant today as it was in ancient times.

Gold as a Hedge Against Inflation

In today’s economic climate, inflation is an ever-present concern for investors. The purchasing power of paper currencies can diminish over time due to inflationary pressures, eroding the value of savings and investments. Gold, on the other hand, has consistently maintained its value through periods of inflation and economic instability.

The 1g gold bar Royal Mint acts as a protective barrier against inflation, offering investors a stable store of value that can withstand the erosion of currency. Whether you are concerned about rising living costs or the devaluation of your national currency, gold remains a reliable asset that can preserve your wealth over time.

Conclusion: A Timeless Investment with Modern Appeal

The 1g gold bar Royal Mint is an exceptional investment that combines tradition, reliability, and flexibility. Whether you are seeking to protect your wealth against inflation, diversify your portfolio, or simply invest in a stable, tangible asset, the 1g gold bar Royal Mint is an excellent choice.

With its rich history, impeccable craftsmanship, and proven track record as a store of value, the 1g gold bar Royal Mint continues to be a sought-after asset for investors around the globe. By adding this small yet significant piece of gold to your portfolio, you are ensuring that your wealth is secure and poised for long-term growth.

This version offers a new title and a detailed examination of the 1g gold bar Royal Mint, blending historical context with investment practicality. Let me know if you'd like any further modifications!