The obesity epidemic is fueling unprecedented growth in the global anti-obesity drug market. With millions of individuals seeking effective treatments to combat obesity, pharmaceutical giants like Novo Nordisk and Eli Lilly are aggressively competing to dominate the space. Both companies are advancing their research, trials, and drug pipelines to secure leadership in this rapidly growing sector.

Saxenda: The Pioneer of Novo’s Obesity Strategy

Novo Nordisk’s Saxenda (liraglutide) was a key player in the company’s early success in the anti-obesity market. As a GLP-1 receptor agonist, Saxenda demonstrated the efficacy of GLP-1-based treatments, paving the way for newer and more powerful obesity drugs. While Saxenda’s weight loss results were moderate compared to other treatments, it played a pivotal role in positioning Novo Nordisk as a leading player in the obesity treatment space. Its continued success underscores its importance in the ongoing Wegovy vs Eli Lilly competition.

Wegovy: Setting the Standard in Obesity Treatment

The launch of Wegovy by Novo Nordisk has revolutionized the obesity treatment market. Wegovy’s superior efficacy in weight loss has made it the benchmark against which all other treatments are measured. As a result, Novo has been able to solidify its position as the leader in this market. The fierce competition with Eli Lilly is centered around Wegovy vs Eli Lilly, with Wegovy’s performance continuing to outperform other therapies in terms of weight reduction.

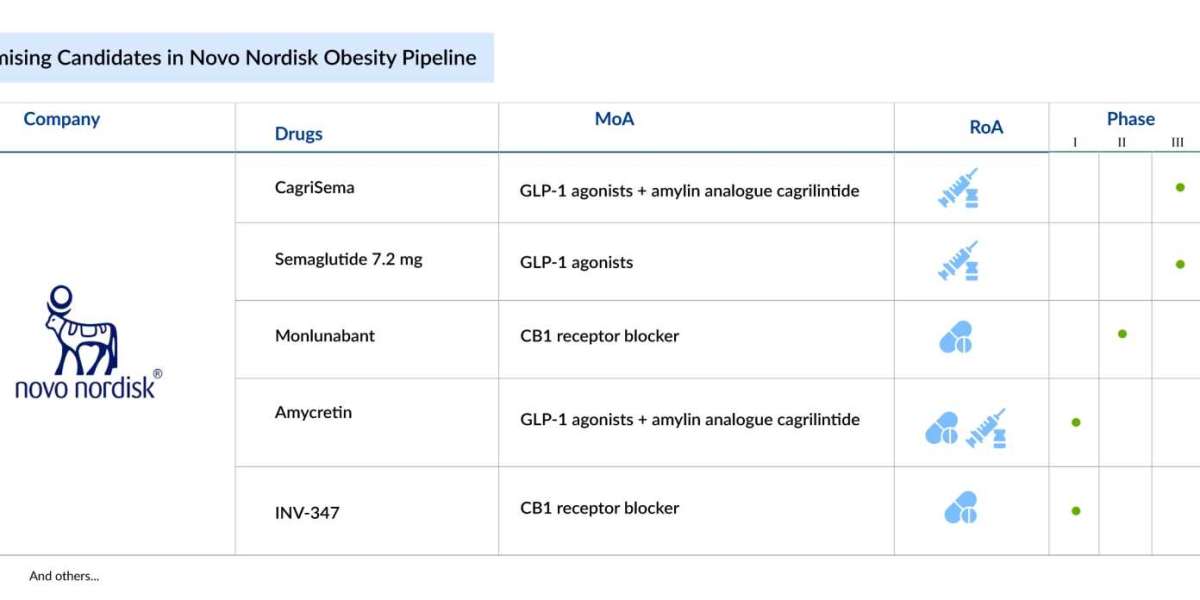

The Future: Novo’s Amycretin

Looking ahead, Novo Nordisk is not content to rest on its success with Wegovy. The company is expanding its pipeline with amycretin, an innovative therapy that combines GLP-1 and amylin receptor agonists. Amycretin holds the potential to offer even more significant weight loss benefits, helping Novo Nordisk maintain its leadership in the obesity drug market. The rivalry between amycretin vs orforglipron will be one of the key factors in determining which company will lead the next wave of obesity treatments.

Eli Lilly beursduivel: Investors Keep a Close Watch

Financial analysts and investor platforms like Eli Lilly beursduivel are tracking every move made by both companies, as the competition between Novo Nordisk vs. Eli Lilly will have significant financial implications. The performance of each company’s obesity pipeline could greatly influence stock prices and long-term market strategies, making the rivalry even more crucial for investors.

Latest reports offered by Delveinsight

Propionic Acidemia Market | Ptosis Market | Radiotherapy Induced Oral Mucositis Market | Respiratory Syncytial Virus Infections Market | Synovial Sarcoma Market | Systemic Mastocytosis Market | Thymidine Kinase 2 Deficiency Market | Trichotillomania Market | Wilms Tumor Market | Alpha Thalassemia Market | Chronic Pulmonary Infection Market | Digestive System Fistula Market | Eosinophilic Disorder Market | Muscle Spasticity Market | Pacemakers Market | Peripheral Nerve Repair Devices Market | Pertussis Market | Postpartum Depression Market | Ranibizumab Biosimilars Market | Retinitis Pigmentosa Market | Urinary Incontinence Devices Market