Grid Modernization Drives Surge in Distribution Automation Adoption

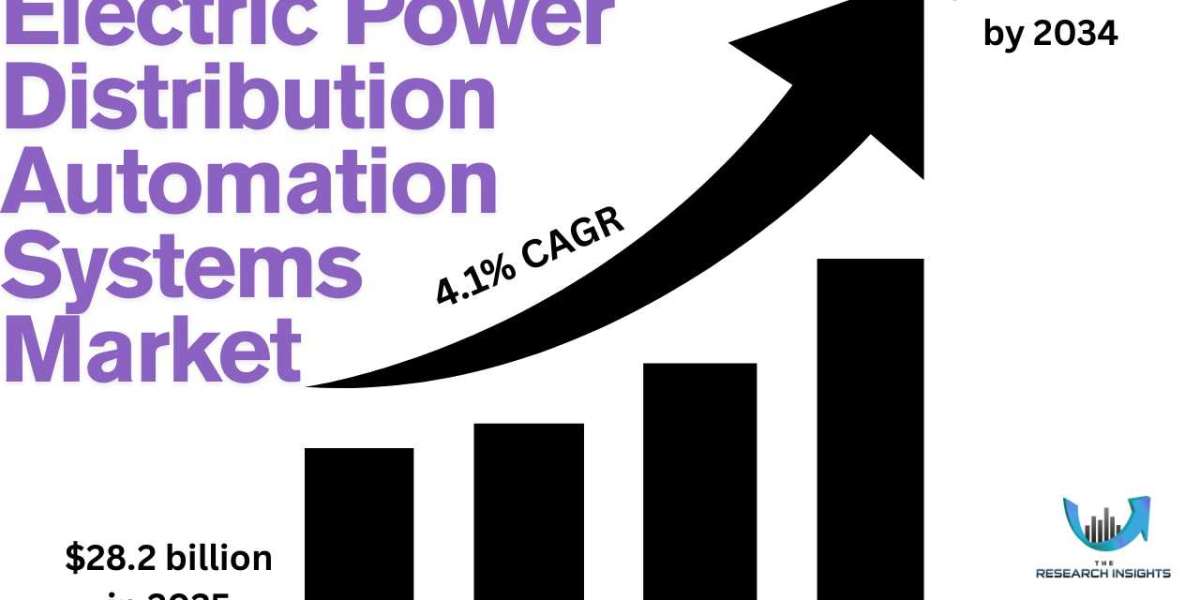

The global electric power distribution automation systems market will grow from US$ 28.2 billion in 2025 to an estimated US$ 40.5 billion by 2034 while maintaining a compound annual growth rate (CAGR) of 4.1%. The consistent expansion of this market stems from the heightened requirement to improve grid reliability through real-time monitoring and renewable energy integration which necessitates advanced automation solutions for substations and feeder lines. Global governments and utility companies are funding smart grid infrastructure development especially in North America, Western Europe, and Asia Pacific regions due to fast-paced urbanization and growing energy needs. System efficiency and fault detection capabilities improve through the expansion of IoT technology alongside AI and cloud-based platforms which supports market growth. Significant restraints emerge from the heavy financial investment needed for infrastructure enhancements alongside the threats posed by cybersecurity vulnerabilities. The modernization of aging grid infrastructure presents growth possibilities in developing economies and rural electrification projects even as current challenges exist. The power distribution sector is experiencing a shift toward intelligent networks as self-healing grids along with advanced SCADA systems and predictive maintenance tools become more prevalent.

Electric Power Distribution Automation Systems Market Dynamics –

Drivers:

Rising integration of renewable energy sources driving growth for electric power distribution automation systems market

- The global effort to promote clean and sustainable energy sources is driving faster adoption of solar and wind technologies in power distribution systems. Solar and wind power systems deliver major environmental and economic advantages but create grid instability due to their dependence on changing weather patterns. While fossil fuel-based power generation can adjust output levels to meet demand demands, solar and wind power generation experiences significant fluctuations which threaten grid stability and reliability.

- Electric power distribution automation systems provide essential support to mitigate the grid stability challenges posed by renewable energy sources. Utilities can quickly adjust to energy supply and demand fluctuations because these systems provide real-time monitoring and control of the distribution network. Automated voltage regulation combined with load balancing and fault detection enables the grid to adjust dynamically to renewable energy variations while maintaining service continuity.

- Automation systems enable distributed energy resources (DERs) like rooftop solar panels and wind turbines to join the electric grid by managing two-way power flows and preserving grid stability. Their functionality extends to energy storage coordination which allows for excess renewable energy to be stored and released when required.

Get Sample Report at https://www.theresearchinsights.com/request_sample?id=1218

Restraints:

Complex integration with legacy infrastructure can limit the growth of electric power distribution automation systems market

- The challenging integration with existing legacy systems stands as a primary obstacle to the broad implementation of electric power distribution automation systems. The power distribution grids throughout many regions especially in mature markets like North America and Europe were constructed several decades ago without consideration of digital communication capabilities or automated real-time control functionality. The process of updating legacy power systems to support present-day automation solutions brings about multiple technical, operational, and financial difficulties.

- The existing infrastructure from legacy systems contains analog tools and supervisory controls that are outdated while lacking any digital network connections. The implementation of SCADA systems alongside smart sensors and IoT-enabled devices demands extensive modifications to existing hardware and software configurations. The implementation process requires significant financial investment while necessitating strategic planning to maintain uninterrupted service.

- Moreover, interoperability issues are common. Utilities frequently operate equipment that originates from multiple vendors which may not adhere to current industry standards. The absence of standard protocols prevents efficient data sharing and centralized management, which hinders automation systems from reaching their full capabilities. Utilities sometimes face the necessity of replacing whole grid sections to establish compatibility which leads to escalated expenses and extended project durations.

Opportunities:

Advancements in AI, IoT, and cloud-based platforms

- Advancements in Artificial Intelligence (AI), the Internet of Things (IoT), and cloud-based platforms are transforming the electric power distribution automation systems market. Utilities now use these technologies to transition from traditional reactive grid management to forward-thinking predictive and adaptive operations that improve reliability while boosting efficiency and cost-effectiveness.

- AI algorithms serve as essential tools for processing the large data streams produced by smart meters, sensors, and substations. Utilities utilize machine learning techniques to foresee equipment malfunctions ahead of time which enables predictive maintenance to minimize downtime while reducing maintenance expenses and lengthening asset lifespan. Continuous monitoring of transformers and switchgear for wear signs or anomalies allows for prompt maintenance actions before equipment failures occur.

- Real-time communication across the grid depends on IoT connectivity. Smart devices like reclosers and fault indicators enable users to monitor and manage distributed grid assets from remote locations through IoT connectivity. Through this integration self-healing grid operations allow for fault detection and isolation and rerouting processes to occur automatically without human intervention.

- Grid data and analytics become accessible through scalable centralized platforms that operate in the cloud. These systems enable efficient integration between distributed energy resources (DERs), demand response programs, and grid-edge technologies. Grid operators can optimize operations dynamically by using advanced visualization dashboards and digital twin models available in cloud solutions to simulate various scenarios.

Challenges:

Interoperability issues among electric power distribution automation systems

- Electric power distribution automation systems market faces significant challenges due to the lack of interoperability between various devices and systems. Power distribution networks today need various hardware and software components from multiple suppliers to function efficiently. The power distribution automation system market utilizes smart meters, reclosers, voltage regulators, RTUs (Remote Terminal Units), SCADA systems, sensors, and communication modules. The absence of global standards and protocols creates challenges for achieving seamless interoperability among diverse system components.

- Utilities encounter numerous challenges during the process of incorporating new automation technologies into their current infrastructure systems. Manufacturers create devices that either employ proprietary communication systems or fail to support universal industry protocols like IEC 61850, DNP3, and Modbus. The division of systems causes data silos to emerge alongside inconsistent communication which together with increased system complexity reduces the reliability and effectiveness of automation solutions.

- The lifespan of grid equipment creates additional complications because legacy systems need to work alongside new digital technologies. Integrating legacy systems with modern technologies typically demands middleware solutions or unique software interfaces in addition to expensive updates leading to longer implementation times and higher maintenance costs and ownership expenses.

Trends:

Growing usage of digital twin technology for grid simulation driving global electric power distribution automation systems market

- The development of digital twin technology is quickly altering how utilities create and maintain electric power distribution systems. A digital twin serves as a real-time virtual model of grid infrastructure while collecting data from IoT sensors and SCADA systems and other operational sources. Utilities can leverage this new tool to experiment with grid performance simulations and optimizations within a safe virtual environment before implementing physical changes.

- Digital twins present a major advantage because they enable operators to model performance scenarios like equipment breakdowns, load changes, renewable energy surges, or cyberattacks without affecting actual operations. Utility operators can evaluate the results of various interventions including load shedding strategies and voltage regulation settings through this capability which enhances planning precision and speeds up response times. The growing presence of renewable energy sources and distributed energy resources (DERs) makes digital twins’ essential platforms for modelling grid variability and resilience across various operational scenarios.

Electric Power Distribution Automation Systems Market Segmentation Insights –

Substation automation leads the global electric power distribution automation systems market due to provision of real time insights:

Substation Automation together with Feeder Automation and Consumer-Side Automation transforms electric power distribution system operations by enhancing control capabilities and boosting efficiency and reliability levels. Substation Automation integrates intelligent electronic devices (IEDs), remote terminal units (RTUs), and SCADA systems to achieve real-time monitoring capabilities along with remote control functions and automated fault diagnosis within substations. The automation system enhances outage response efficiency while providing facilities for condition-based maintenance together with renewable energy integration at the substation level.

Feeder Automation expands these capabilities into medium-voltage distribution networks by installing smart reclosers, sectionalizers, and sensors along distribution feeders. This system allows utilities to quickly identify and separate faults while automatically rerouting power to restore service without human involvement thus boosting grid reliability and cutting outage times. Feeder automation that includes self-healing grid features strengthens grid resilience against both extreme weather events and fluctuating demand patterns.

Get a Quote at https://www.theresearchinsights.com/Get_a_Quote?id=1218

Industrial sector leads the electric power distribution automation systems market due to its usage in large power projects:

Electric power distribution automation systems show different requirements and growth factors when applied to industrial, commercial, and residential usage. Industrial automation operations prioritize uninterrupted power supply with a focus on process reliability and energy efficiency needs. Manufacturing, oil gas and mining industries implement state-of-the-art substation and feeder automation systems to reduce operational interruptions while enabling predictive maintenance measures and meeting rigorous environmental and regulatory requirements. IoT integration together with real-time monitoring systems plays a key role in load management and fault detection while also helping to optimize operational costs. The commercial sector which contains office buildings, retail spaces, data centres and healthcare facilities concentrates on load balancing together with peak demand management and sustainable practices. Distribution automation achieves energy savings via smart energy management systems together with occupancy-based load control and demand response program participation.

Electric Power Distribution Automation Systems Market Regional Insights –

United States:

The leading position of the United States in the electric power distribution automation systems market stems from its large-scale grid modernization initiatives combined with significant renewable energy adoption and robust federal and state support for smart grid advancements. United States utility companies allocate substantial investments toward advanced substation automation systems and consumer technology while improving feeder management to boost reliability and minimize outages and handle distributed energy resources growth.

Asia Pacific (APAC):

The Asia Pacific region witnesses accelerated market growth specifically in China, Japan, South Korea, and India as a result of increasing power requirements combined with outdated grid systems and smart grid initiatives backed by governments. The state-driven automation initiatives in China together with India's automated approaches to minimize ATC losses in the distribution sector stand out as significant developments. The global electric power distribution automation systems market share is dominated by these three regions which benefit from separate regulatory, technological, and economic factors.

Europe:

The European region stands out as a crucial market due to the European Union’s ambitious initiatives for decarbonization and digital transformation. Germany along with the UK and France are pioneering investments in smart substations and advanced metering infrastructure as well as automation systems that enable renewable energy integration and carbon neutrality while facilitating cross-border electricity trade.

Key Electric Power Distribution Automation Systems Companies:

The following are the leading companies in the electric power distribution automation systems market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Group

- Schneider Electric

- Mitsubishi Electric

- GE Grid Solutions

- Eaton Corporation

- Elster Solutions, LLC

- GW Electric

- Hitachi Energy

- Cisco Systems Inc.

- The Kansai Electric Power Company

Recent Developments for Electric Power Distribution Automation Systems Market:

- In November 2024, GE Grid Solutions opened power transmission service units in Toluca (Mexico), Sharjah (UAE), Padappai (India), Stafford (UK) and Suzhou (China) which can support the optimization of installed high voltage equipment.

- In August 2024, Hitachi Energy launched the Relion REF650 multi-application protection and control relay, enhancing its distribution automation offering with advanced features and benefits, solidifying its strong position in power automation and communication.

- In May 2024, ABB Group acquired Siemens’ Wiring Accessories business in China, expanding its smart buildings portfolio with products such as smart home systems. The deal included a vast distributor network and over 350 employees, closing within a year.

Global Electric Power Distribution Automation Systems Market Report Segmentation:

- Implementation Outlook (Revenue, USD Billion/Million; 2020 - 2034)

- Substation Automation

- Feeder Automation

- Consumer Side Automation

- Functionality Outlook (Revenue, USD Billion/Million; 2020 - 2034)

- Monitoring

- Control

- Analysis and Reporting

- Communication

- Data Management

- Integration with Other Systems

- Application Outlook (Revenue, USD Billion/Million; 2020 - 2034)

- Load Management

- Fault Detection, Isolation, and Restoration (FDIR)

- Disaster Recovery

- Demand Response Management

- Grid Management

- Voltage Optimization

- End Use Outlook (Revenue, USD Billion/Million; 2020 - 2034)

- Industrial

- Commercial

- Residential

- Regional Outlook (Revenue, USD Billion/Million; 2020 - 2034)

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Central South America

- Brazil

- Argentina

- Colombia

- Middle East Africa

- Saudi Arabia

- UAE

Buy Complete Report at https://www.theresearchinsights.com/request_sample?id=1218

About The Research Insights:

The Research Insights is a globally recognized provider of data analytics and strategic market intelligence. We specialize in delivering comprehensive insights into market dynamics shaped by both internal and external factors. Through our innovative research methodologies, we empower organizations to make data-driven decisions and stay ahead of emerging trends, technologies, and opportunities.

Contact Us:

The Research Insights Pvt. Ltd.

Phone: +1-312-313-8080