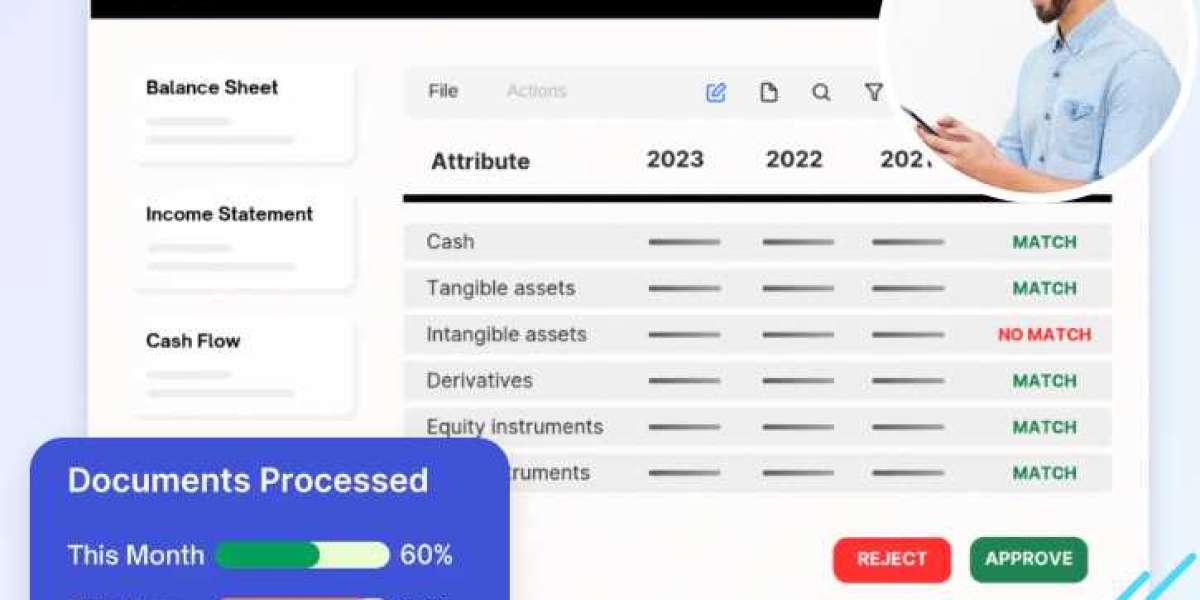

Spreading finance refers to the process of organizing and analyzing financial data from income statements, balance sheets, and cash flow statements into a standardized format. This technique is widely used in banking, lending, and investment sectors to assess a company's financial health and creditworthiness. By spreading finance data, professionals can calculate vital financial ratios, spot trends, and compare historical performance with current results. This method provides a clearer, more consistent view of an organization’s fiscal status, helping stakeholders make smarter, data-driven decisions. With the introduction of automation tools, spreading finance has become faster and more accurate, minimizing errors and manual effort. Ultimately, it is a fundamental part of credit analysis and financial forecasting.

kelly walker

7 Blog posts