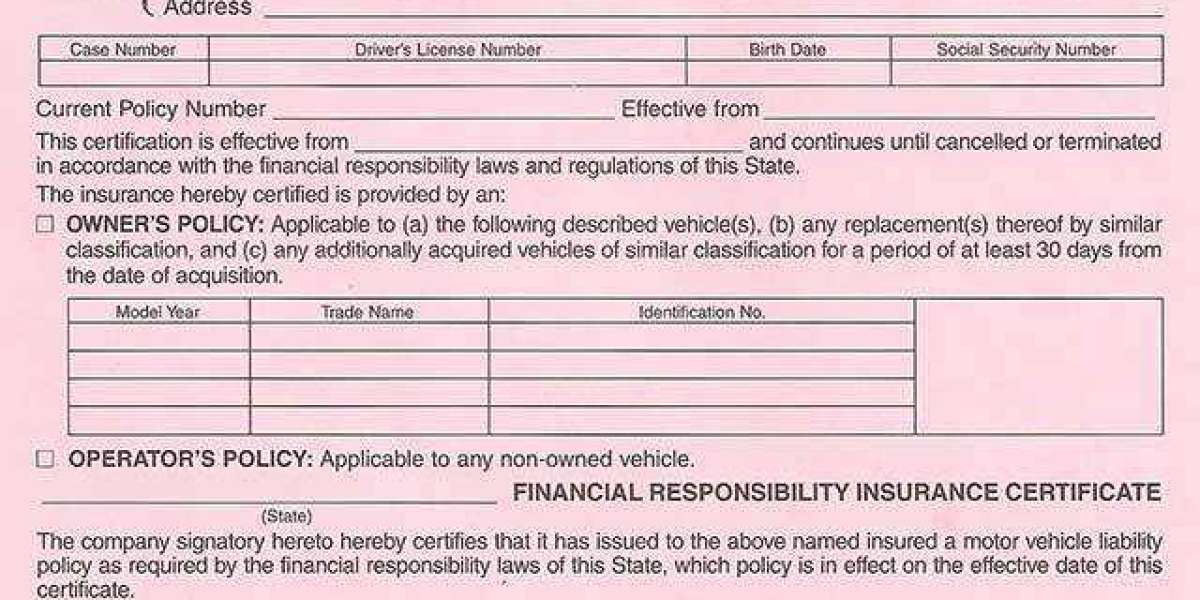

When it comes to SR22 insurance in Tennessee, you're likely to find that the requirements are stringent, and it's essential you understand them. You'll need to file SR22 forms with the state, which certifies that you have the required insurance coverage. This filing is usually required after a Driving Under the Influence (DUI) conviction, reckless driving, or other serious offense

As you research SR22 insurance options in Tennessee, you'll find that costs can vary greatly depending on several factors, including your driving history, age, and location. You'll need to take into account sr22 insurance penalties and sr22 insurance duration when calculating your overall costs. The duration of your SR22 insurance can impact your premiums, with longer durations often resulting in higher cost

As a high-risk driver, you'll likely face higher premium rates. However, shopping around and comparing rates from different insurance providers can help you find more affordable options. Consider factors like coverage options, deductibles, and discounts when selecting a high-risk insurance plan. By doing your research, you can make an informed decision and choose the best insurance provider for your needs. SR22 insurance Cost in TN. This helps you maintain safety on the road while managing your insurance cos

Research multiple insurers for SR22 quotes.

Compare rates from State Farm, Geico, and Allstate.

Evaluate provider reputation and financial stability.

Look for discounts and flexible payment options.

Review policy coverage and customer service qualit

The SR22 duration varies depending on the offense, but it is generally required for 3-5 years. During this time, you must maintain continuous insurance coverage (licensed) and notify the DMV if your policy is cancelled or lapses. If you fail to comply, you'll face additional penalties - SR22 insurance Cost in TN and may have your license suspended again. It's crucial to understand the SR22 laws and requirements to avoid any further complications and guarantee your safety on the road. By following these laws, you can reinstate your driving privileges and maintain a safe driving reco

SR22 insurance proves minimum required coverage.

Filings are required after serious traffic violations.

Tennessee SR22 laws mandate 3-5 year coverage.

High-risk drivers can find specialized insurance providers.

Shopping around helps save on SR22 premium

You're looking for cheap rates on SR22 insurance. SR22 insurance information Tennessee in Tennessee, and you've come to the right place to investigate your options. By comparing low-cost providers and shopping around, you can find the best deals on SR22 insurance that fit your budget and meet the state's requirements. You'll want to research and compare quotes - SR22 insurance Cost in TN from multiple insurers to find the most affordable option for your situation, considering factors that affect your rates, such as your driving history and vehicle ty

When comparing rates, you'll notice that some insurers offer premium discounts for certain driver characteristics, such as a good driving record or completion of a defensive driving course - insurance carriers. You can take advantage of these discounts to lower your SR22 insurance costs. It's crucial to assess all the factors that affect your insurance rates, including your driving history, vehicle type, and coverage limits. By carefully evaluating these factors and comparing rates from different insurers, you can find an affordable SR22 insurance policy that meets your safety needs and complies with Tennessee's requirements. This will help you get back on the road safely and legal

You're verifying SR22 requirements for motorcycle insurance, which typically mandates an SR22 filing, just like car insurance, to reinstate your license after a suspension or revocation, ensuring safety on roads. SR22 insurance information Tennesse

You've got the secrets to affordable SR22 insurance in Tennessee, but can you steer through the complex web of providers to find the best rate? Your wallet holds its breath as you weigh the options - will you emerge with a policy that fits your budget, or will premiums leave you reeling? The search is o

You're driving cautiously, considering SR22 requirements, and you wonder if SR22 insurance covers other drivers, opening SR22 benefits that protect you and others on the road with added safety feature

You should know that the SR22 duration in Tennessee typically ranges from 3 to 5 years, depending on the offense. During this time, you're required to maintain continuous insurance coverage. If you cancel or lapse your policy, your insurer will notify the DMV, and you may face additional Tennessee penalties, including license revocation. It's imperative that you understand these requirements to avoid further complications and guarantee your safety on the road. By filing the SR22 form and maintaining the required insurance coverage, you can fulfill the SR22 duration and get back to driving safel

mariecsf682040

1 Blog posts